A world-class gold deposit supported by a world-class team

A world-class gold deposit supported by a world-class team

U.S. GoldMining Inc. (NASDAQ: USGO) (“USGO”, “U.S. GoldMining” or the “Company”)

Paid sponsorship

U.S. GoldMining Inc. (NASDAQ: USGO)

The story at a glance:

- Gold majors on the hunt for promising assets: As big mining companies run out of gold, they're actively searching for the next big prospective mine to take on

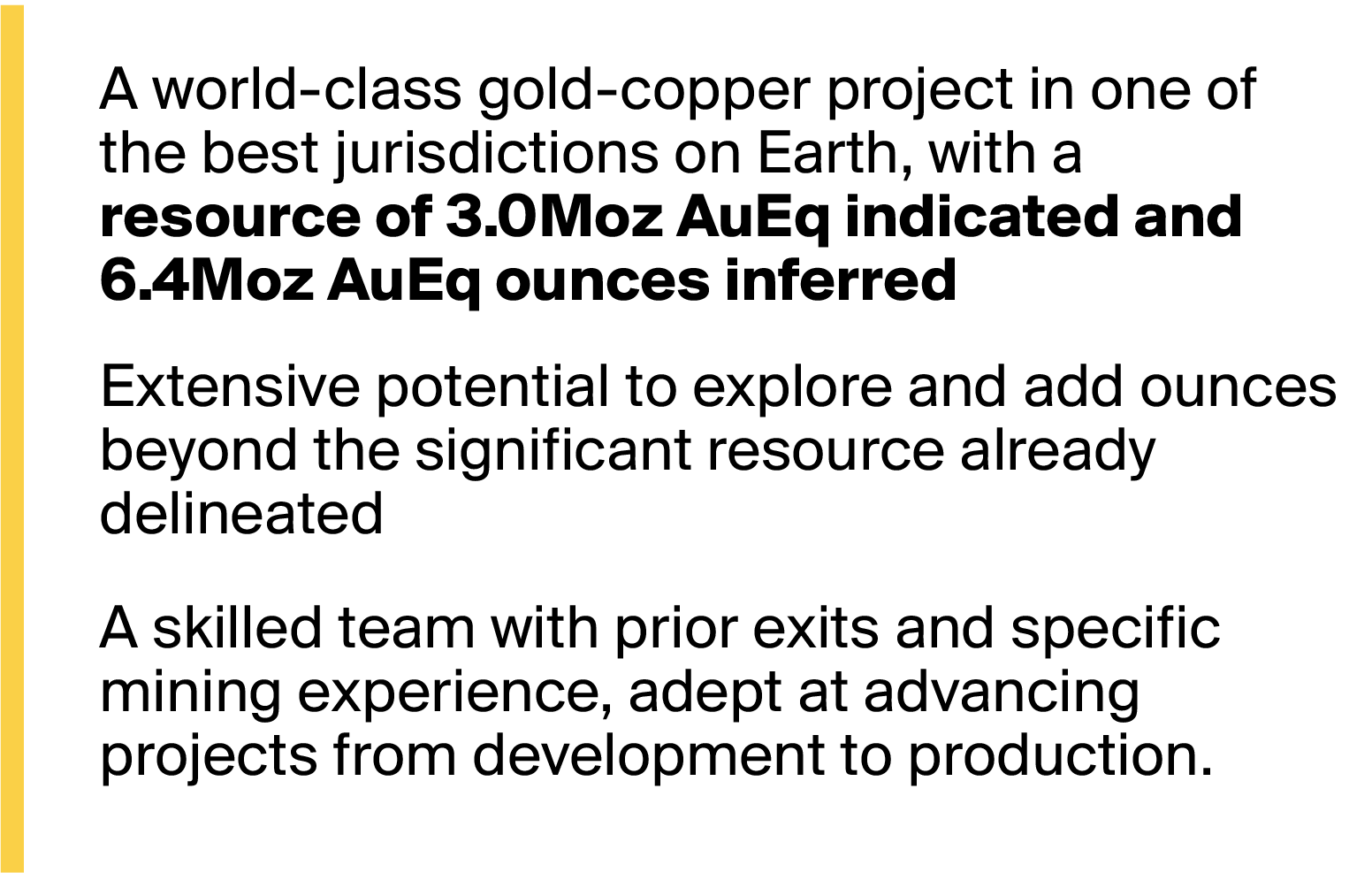

- District-scale flagship project: Whistler is a district-scale project in Alaska with 3.0 million gold-equivalent ounces indicated and 6.4 million AuEq oz inferred1

- Proven team: Includes CEO Tim Smith, responsible for the discovery of the Coffee gold deposit acquired by Goldcorp (now owned by Newmont) for CA$520 million, and Chair Alastair Still, who has directed the acquisition, construction, or operation of gold mines at Newmont, Goldcorp, Placer Dome, and Kinross

- Prime target for acquisition: With years of experience working for the majors, the U.S. GoldMining team aims to tick every box for Whistler that potential acquirers look for

- News on the way: Big moves in the near future and updates coming soon

- Fully-funded, with no near-term dilution: With approximately US$11.4 million in cash on hand, USGO is well-financed for its current goals, with no plans for a private placement in the immediate future

A district-scale flagship gold project, primed for a potential takeout by a major mining company

It's a simple story: the world's major mining companies are running out of gold, and they need to acquire new projects to refill their coffers. The newly-minted mid-stage exploration company, U.S. GoldMining Inc. (NASDAQ: USGO) may be an ideal target.

But before we get into what makes USGO such an attractive investment, a little background.

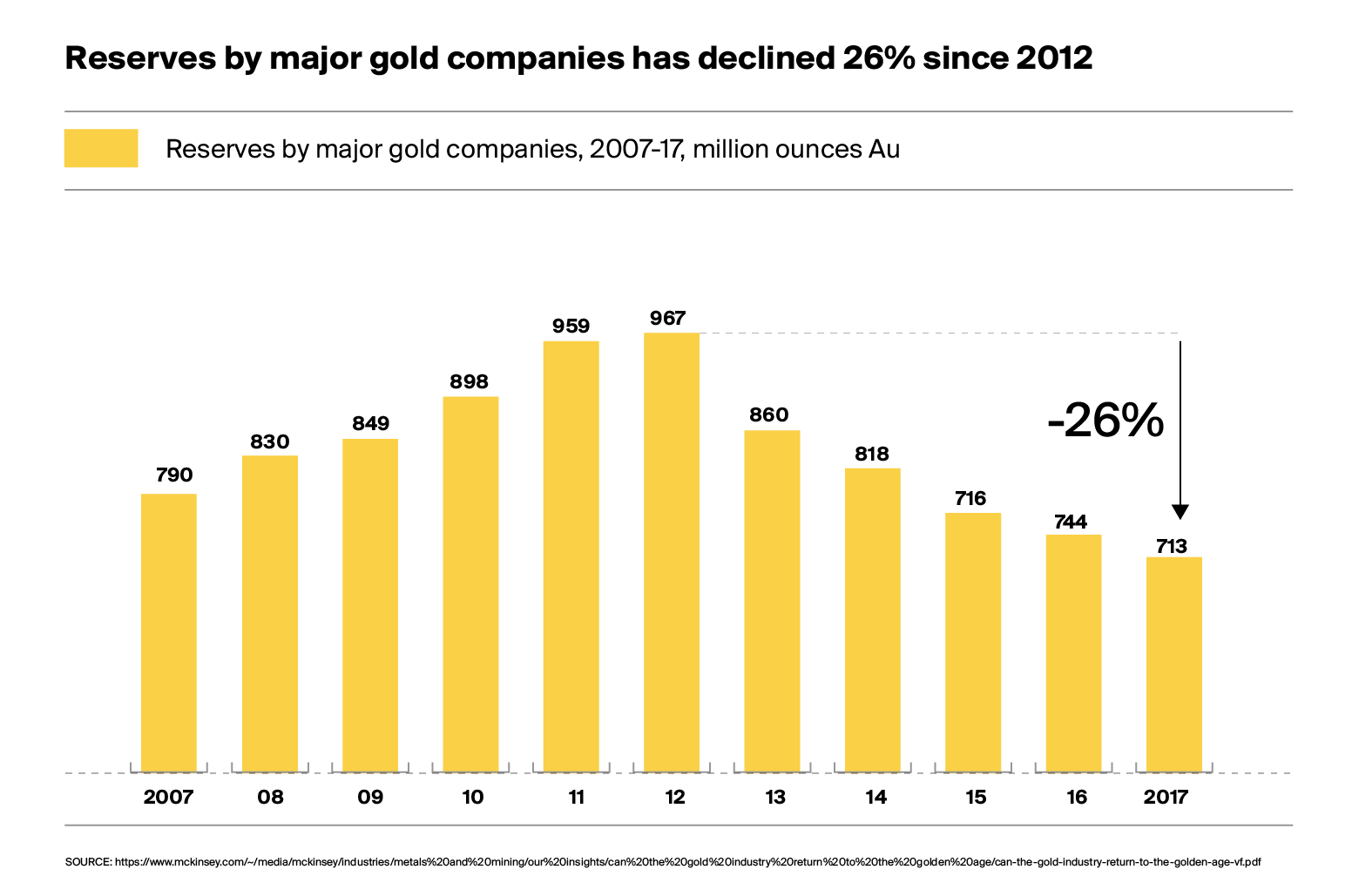

Between 2012 and 2017, reserves of major gold miners including Barrick, Agnico Eagle, Goldcorp, Kinross, and many more declined by a cumulative 26%—dropping from 967 million ounces to 713 million ounces.2

Today, seven years later, those reserves have fallen even lower, a problem made worse by the fact that at the time of writing, the price of gold recently cracked an all-time high, and now sits near a new one.

The world's biggest mines are increasingly being tapped out. As a result, the majors are forced to look for new projects, hunting down properties with proven ounces in the ground that are being explored by competent and professional teams with the savvy and know-how to reveal their hidden potential.

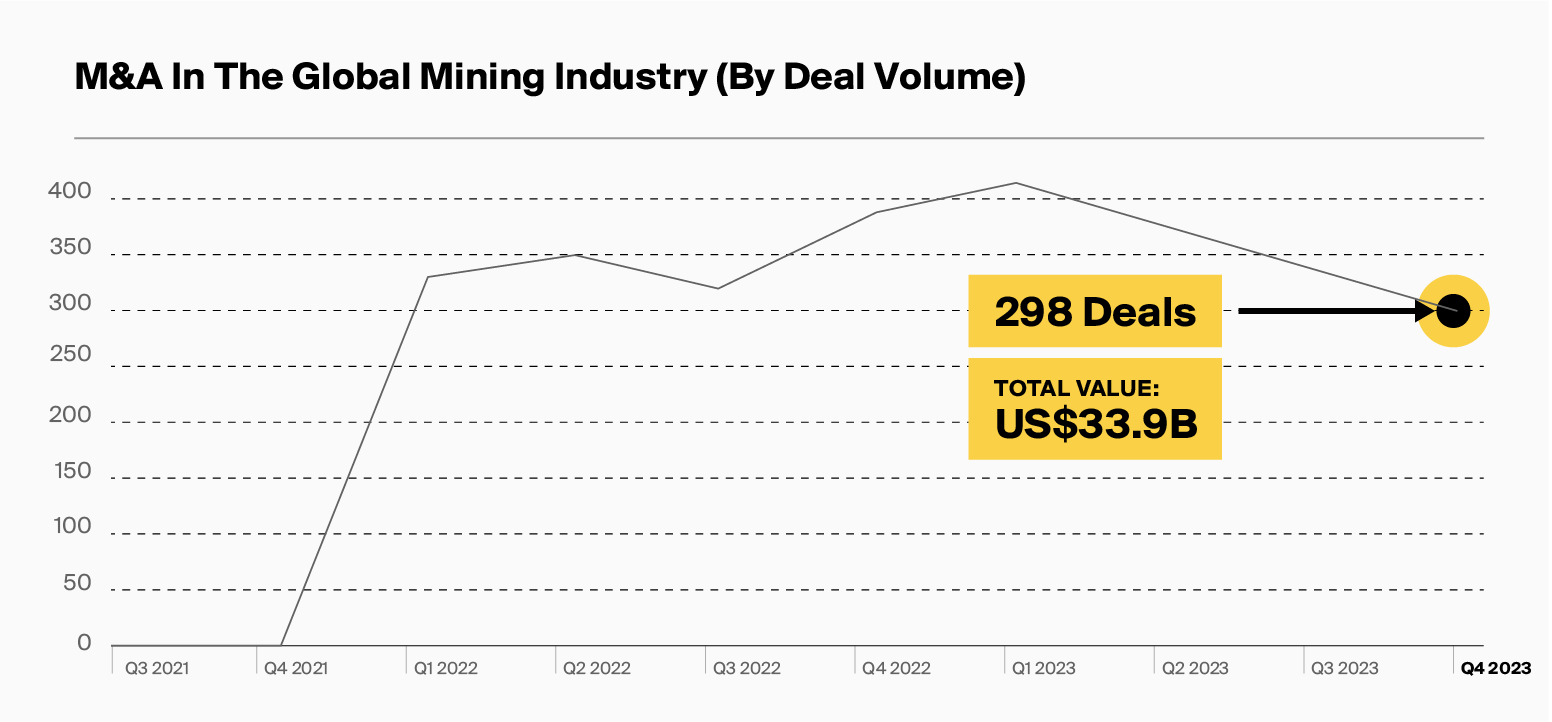

It's happening all the time: in the fourth quarter of 2023 alone, there were 298 M&A deals announced, with a total value of US$33.9 billion.3

Today, major miners are paying a premium for compelling development-stage assets. And USGO's Whistler project may be one of the most attractive out there.

But that's not the only reason why U.S. GoldMining has generated so much interest since closing an initial public offering just under a year ago.

U.S. GoldMining is a top-of-the-line gold story for three primary factors:

The story becomes even more compelling when you realize the degree to which USGO is undervalued compared to its peers. The Company's enterprise value per ounce is at a lower multiple relative to comparable companies, making it especially desirable.

In short: we believe the stock is, right now, cheap.

With the gold price sitting near an all-time high and the U.S. Federal Reserve signaling rate cuts later this year, gold is potentially poised for a new run. Even without material change, there's no guarantee that USGO's shares will stay at the comparably low price they're currently at.

Not to mention that any of the Company's drill results, expected later this year, could have a serious impact.

It's one of the most straightforward stories you can find among precious metals companies: a district-scale project in a mining-friendly jurisdiction in North America, excellent management, and immediate plans for the future.

Let's dig deeper into each of those factors. First comes Whistler, the project that forms the core of U.S. GoldMining's investment thesis.

The Whistler Gold-Copper Project: A developing story in a mining-friendly jurisdiction

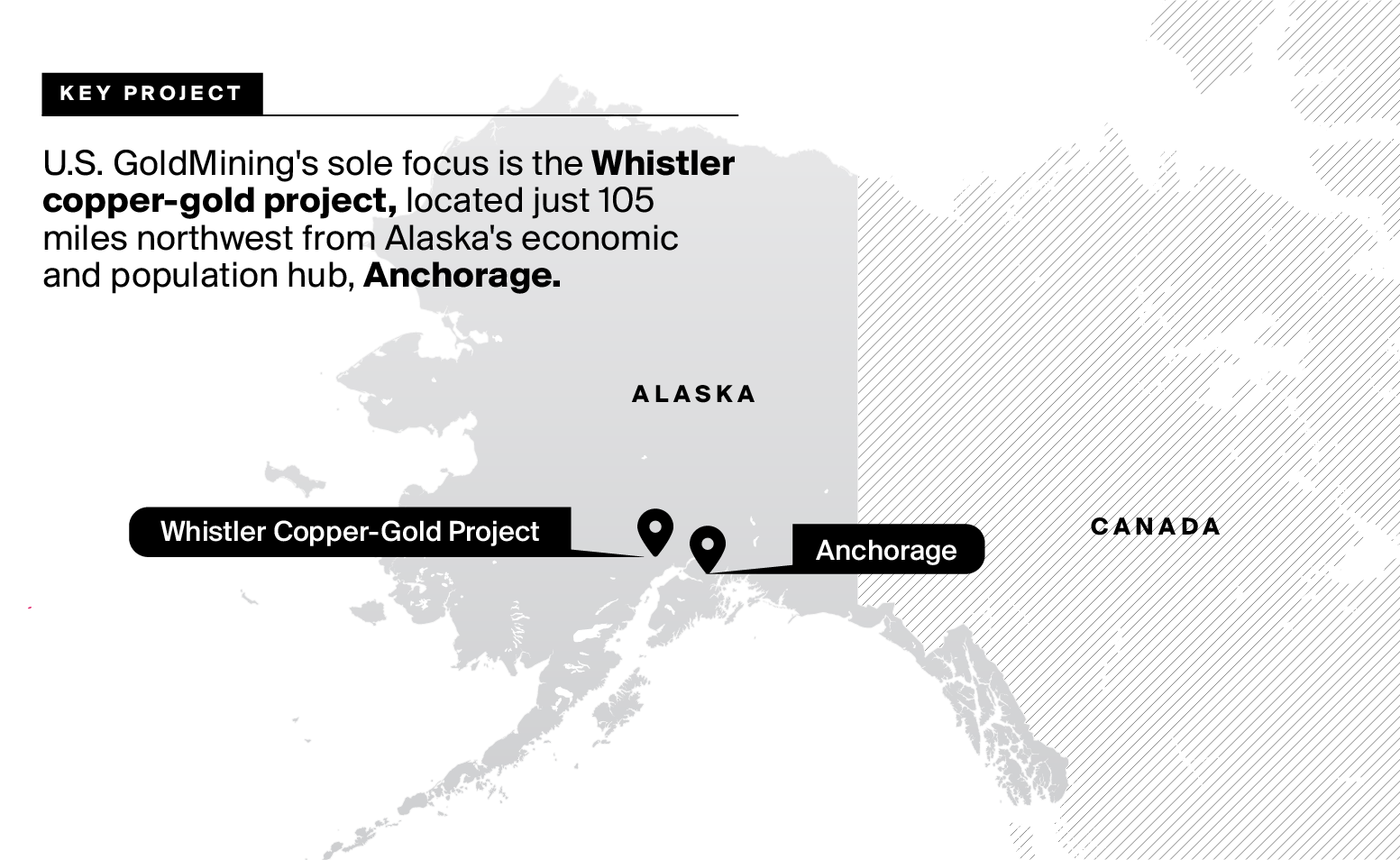

U.S. GoldMining's sole focus is the Whistler gold-copper project, located just 105 miles northwest of Alaska's economic and population hub, Anchorage.

Before we get into the structure of the project and the millions of ounces of gold it potentially hosts, it's worth talking a bit about this location.

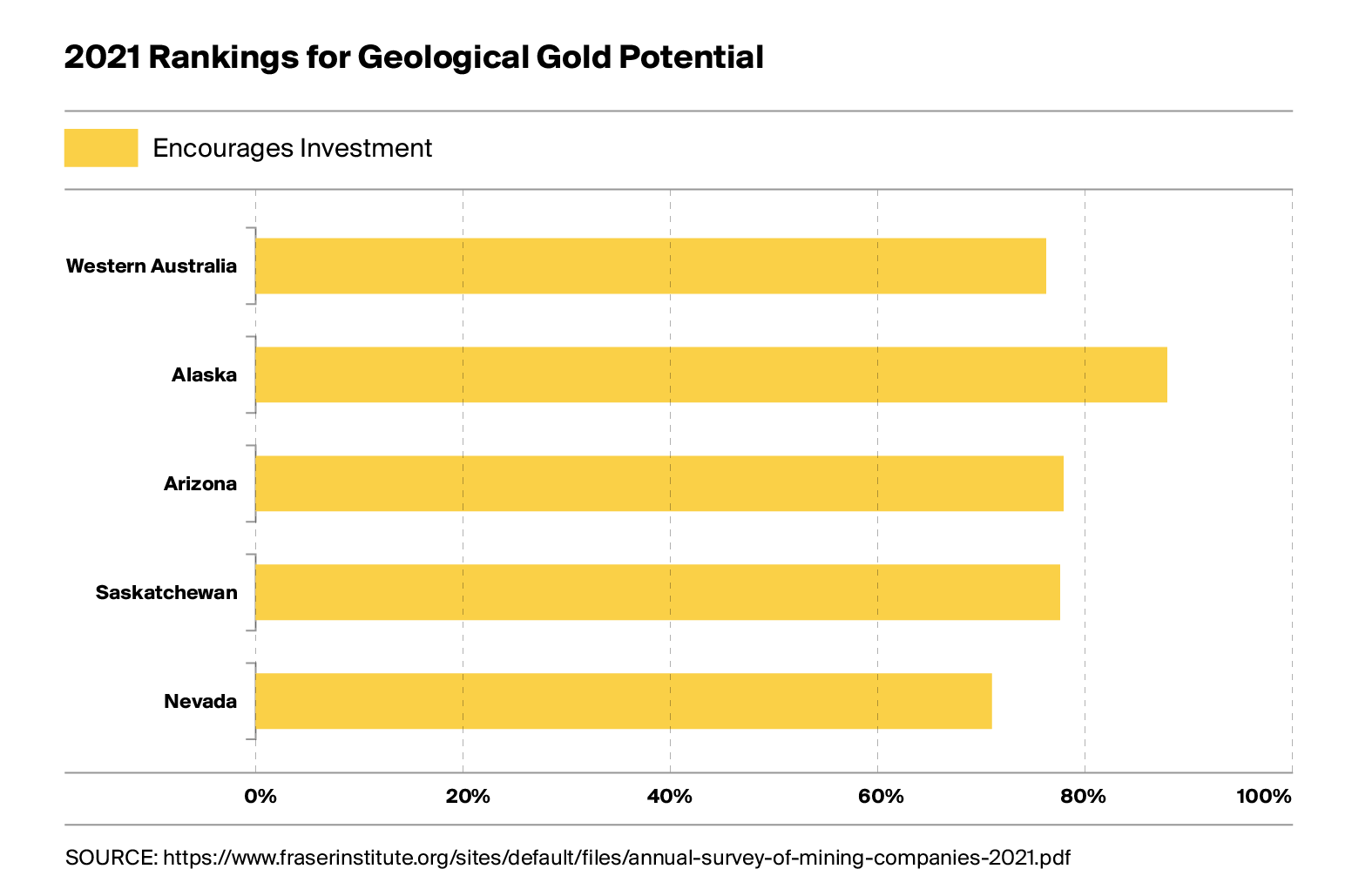

In 2021, Alaska was ranked the #2 best district in the world for geological gold potential by the annual Fraser Institute Survey, and #4 for overall investment attractiveness.

Alaska is well-established as a mining hub, and remarkably supportive of the industry.

What's more, U.S. GoldMining is in good company there. The state is home to some of the biggest mines and deposits in the world, including NOVAGOLD's Donlin project, Kinross's Fort Knox gold mine, Teck's Red Dog base metals mine, Northern Star's Pogo mine, and more.

Alaska is a territory with a long history of tremendously successful mineral extraction projects, with a supportive local government working to invest in mining infrastructure. The state is huge—bigger than Texas, California, and Montana combined—and further world-class discoveries may wait beneath its surface.

Whistler's location may be particularly attractive, even when compared to the successful projects listed above. It's not way off in the wilderness, covered in glaciers at the top of a mountain, which makes it all the more likely to be successful. There's a wide array of positives associated with its prime location:

Just over 100 miles from Anchorage, the biggest population center in the state, equipped with a port, extensive power and infrastructure, a large workforce, and virtually everything else you would need to support an eventual mine.

On a relatively small hill with mild weather for Alaska, in an area that can be mined year-round. Unlike many of the other major deposits in the state, it's fairly easy to access.

The project is located right along one of the "Roads to Resources" planned for construction by the state government in the coming years. The property was already visited by governor Mike Dunleavy back in August 2023 as part of a tour of the proposed road corridor. While the Company won't really need such a road until mine construction actually begins, plans indicate it could come online in the future, which is encouraging. This means access will only get easier as time goes on.

The project is on state land, not federal, Bureau of Land Management, Native land or National Park land. This gives it even more chance of moving through permitting by the mining-friendly state government.

Whistler is located away from environmentally protected areas, e.g. national and state parks and forest reserves. And the Company is working hard to ensure its current activities and potential future mine development minimize the potential impact on the local ecosystem.

Projects in the wilds of Alaska can be subject to intense regulatory scrutiny. Sometimes approval can be wobbly. Northern Dynasty Minerals Ltd.'s Pebble project, effectively blocked in January by the Environmental Protection Agency for threatening critical salmon spawning grounds—is the most high-profile example of this.

However, due to Whistler's location—and the early and ongoing environmental baseline surveys and efforts of its team to start building relationships with stakeholders—USGO is working ;to mitigate such risks.

Whistler is a unique investment opportunity with few direction comparisons. There are other similarly large gold-copper development stories in British Columbia, but those are subject to a much longer and more complex permitting and regulatory path than Whistler is subject to through the Alaska State regulations.

Within Alaska, the aforementioned Donlin project, held by NOVAGOLD and Barrick, is certainly another exciting large-scale development asset, but it's far more remote from infrastructure than Whistler—and already in the hands of a major mining company.

To us, Whistler maintains the ideal balance of scale, proximity to infrastructure, and geologic potential, a complete package upon which to develop a profitable and sustainable future mine.

A whopping 3.0 million ounces indicated and 6.4 million ounces AuEq inferred. 1

Of course, Whistler's location wouldn't matter much if the project didn't have the gold and copper to make it exciting.

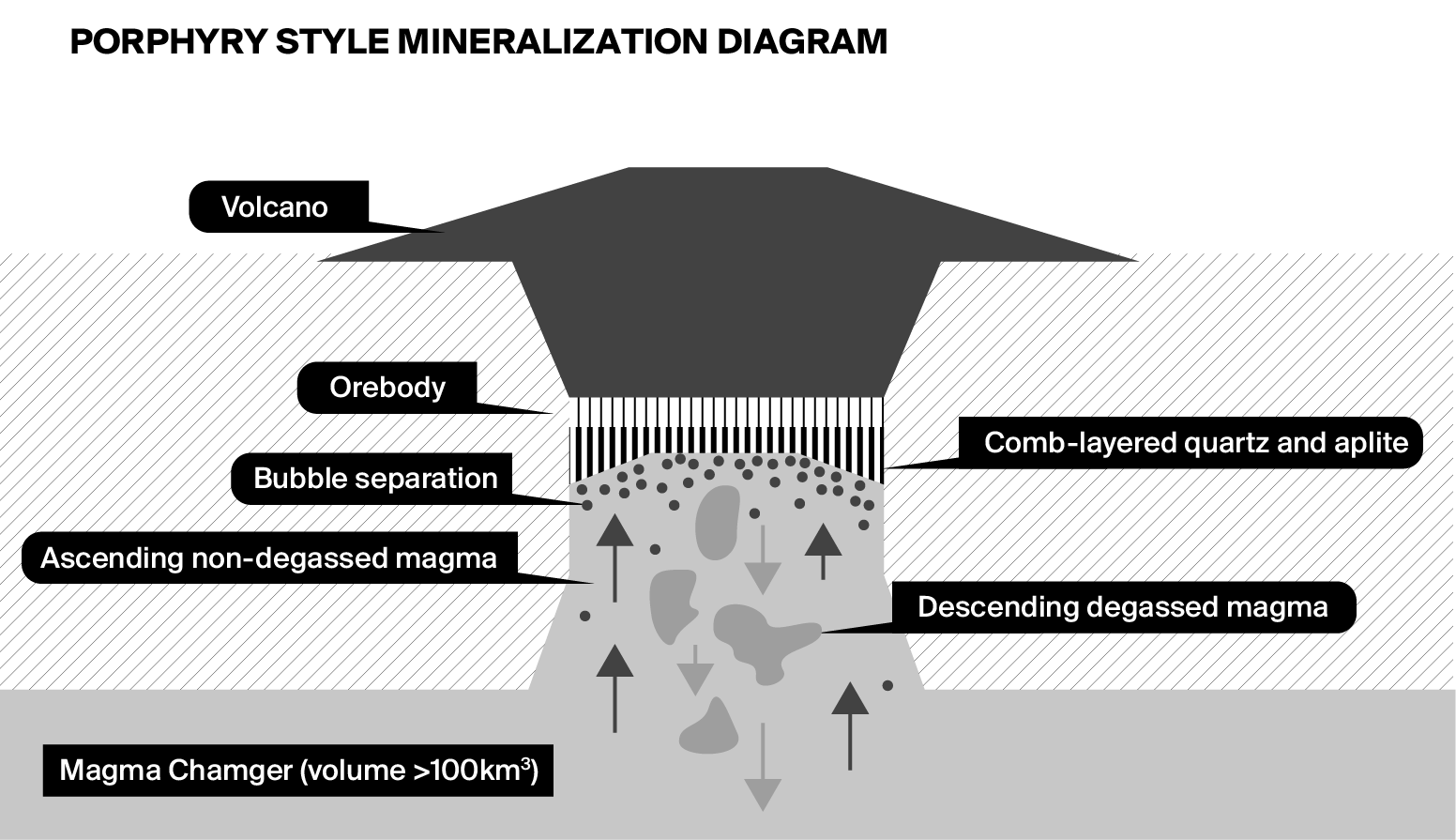

Whistler's three known deposits house porphyry-style mineralization, with big columns of deposits rising from deep in the Earth to near the surface, and including zones of higher-grade at their core. The host porphyry intrusions are the underground roots below ancient, eroded away volcanoes.

These high-grade intersections are wide, running up to hundreds of metres, and sit near the surface of the hill, making it the perfect target for an open-pit mine.

Whistler's previous owners conducted over 70,000 metres of drilling on the property, with their most recent drilling program ending in 2011. The previous owner sold it in 2015, when the gold's average price was only US$1,158 per ounce, to what would later become U.S. GoldMining.

Compare that gold price in 2015 to today, with gold recently breaking a new all-time high at over US$2,200 per ounce, and it's easy to see how much more economical Whistler potentially becomes.

When looking to build an open-pit mine, geologists look for thick sections of high-grade gold. Many factors are involved in determining what's noteworthy, but roughly anything above ~0.5 gold-equivalent grams per tonne (g/t AuEq) is worth a second look.

To put Whistler into perspective, initial results from an ongoing drill program have already revealed the best-ever drill hole from the property, an infill hole along the southern part of the high-grade core which intersected 547.15 metres of 1.06 g/t AuEq, including a zone of 176 metres of 1.55 g/t Au.4

These are promising results on their own, but combined with all the other extensive drilling and strong historical results, they paint a compelling picture of a deposit not only ripe for an open-pit mine, but begging for further exploration to expand its resources.

Across all three deposits—Whistler (by far the biggest), Raintree, and Island Mountain—the pit-constrained resource, plus a minor underground component, comes to 3.0 million ounces AuEq indicated and an inferred 6.4 million ounces AuEq. This is according to an official, independent 2022 technical report.

This mineral resource estimate contains an indicated resource average grade of 0.79 g/t AuEq, and an inferred resource average grade of 0.63 g/t AuEq, perfectly reasonable grades for a project of this scale.

That already places Whistler among the biggest known gold deposits in the world, especially when you limit your search to projects not already in the hands of a major mining company.

But what makes it even more exciting is a high-grade core within the center of each of the three Whistler deposits. In its Technical Reports, the Company demonstrates these high-grade cores in its Mineral Resource Estimate and Sensitivity tables, which show that at $20/t cutoff for example the average grade across all three deposits increases to 1.06g/t AuEq in the Indicated category, and to 0.93g/t AuEq in the Inferred. In 2023, the Company launched a drill program aimed at expanding existing deposits, improving the confidence of its current resources (turning inferred ounces to indicated), potentially discovering new resources on the property, and specifically delineating that high-grade core.

Drilling will begin again at the start of the summer, providing investors with an array of near-term catalysts.

Following that, the Company plans ultimately to consider an inaugural preliminary economic assessment on the project—another massive milestone with significant potential to affect the Company's fortunes.

A project that ticks all the boxes for a potential takeout by the majors.

The blue-sky scenario for U.S. GoldMining is to continue exploring Whistler, expand its resources and advance the project through mine permitting to eventual development. Another route is to potentially partner with or sell to a major or mid-tier mining company.

Big players in the mining sector have to keep producing massive quantities of gold each year, but they rarely explore for new discoveries themselves. As their own mines steadily deplete, they need to acquire projects from smaller companies in order to keep up output.

In order to achieve these goals, the majors look for projects that meet a long list of criteria. You can think of it like a checklist. Whistler already ticks the most important of these boxes, including:

District-scale investment play: Majors like to see huge properties where the entire mineable area is fully owned, and there's abundant potential for further exploration. At 53,700 acres, Whistler fits the bill.

Strong resource base: Majors tend to search for projects with 5-10 million ounces of gold or more showing up in inferred and indicated resources. Whistler's already there, with a good chance of adding further ounces with ongoing exploration.

Room to expand: Majors aim to use their large resources to uncover additional value with the projects they buy, so they look for prospective mines that have a lot of places to expand. Whistler's three deposits have many step-out points and may house a lot of unexplored gold and copper not yet uncovered.

Access to infrastructure: Majors need to be able to justify the economics of building the mine itself, which requires access to roads, equipment, infrastructure, and an eventual workforce to operate the mine as it grows. As we've stated, Whistler is only 105 miles from port, and the Alaska state government is studying the potential to build a road that may go almost straight up to the prospective Whistler mine.

Social license: Majors don't want to get mired in permitting and ESG concerns. Any mine that a big operator would be interested in will last over 20 years, which makes it a generational concern for the local economy. So it's essential that the company from which they buy a project has built generational relationships with the stakeholders surrounding the eventual mine. U.S. GoldMining is ensuring they begin building these relationships right from the jump, and with experts on achieving social license on their team, they've already made extensive progress.

And then there are a host of other concerns—life of mine, mineability, hydrogeology, having the space for tailings and all the other things that come with a mine, long-lead time environmental work—that we don't have time to get into here but which are important considerations to major miners. Suffice it to say that U.S. GoldMining has already addressed, or is working to address, each of them.

U.S. GoldMining aims to advance Whistler and reduce potential production and development risks.

The U.S. GoldMining team is perfect for this mission, with years of experience at Newmont, Goldcorp, Placer Dome, Kinross, and more.

Which brings us to our next point…

A genuinely best-in-class team with region-specific experience, exits in their past, and experience building mines.

When you're considering investing in a precious metals company, the team driving the project is one of the most important factors.

What you want to see is a team with a history of success, with multimillion-dollar exits under their belts and the kind of region-specific know-how that empowers them to succeed exploring and mining the specific area in which they now operate.

U.S. GoldMining's team meets all of these criteria and then some.

First comes the Company's CEO, Tim Smith. Mr. Smith is a lifetime geoscientist with over 25 years of experience, best known for his award-winning discovery of the Coffee gold deposit in his previous role at Kamak Gold. The project was sold to then-Goldcorp (now Newmont) for CA$520 million in June of 2016.

Coffee is positioned in a similar far-north region to Whistler, located south of Dawson City, Yukon. At the time of sale, it contained probable reserves of 2.2 million ounces of gold and exploration potential on 60,000 hectares of land holdings.5

The fact that U.S. GoldMining's CEO comes with the experience of discovering a significant subarctic gold deposit and selling it to a major bodes well for the company's ability to do the same.

On the other side of the acquisition equation is Alastair Still, Chair of U.S. GoldMining. Mr. Still is currently the CEO of GoldMining Inc. (NYSE American: GLDG: TSX: GOLD) and Director of Technical Services at Gold Royalty Corp. (NYSE American: GROY), but perhaps more importantly, he is also the former Director of Corporate Development at Newmont. In that role, and similar roles at Goldcorp, Mr. Still was the force driving corporate development M&A activities at these majors.

The combination of Mr. Smith and Mr. Still's extensive experience in the majors gives us the confidence that this is a team with the know-how to advance Whistler forward.

Furthermore, the rest of USGO's Board of Directors is balanced between industry experts with local Alaskan development expertise, ESG and sustainability experts, and financial experts to guide the Company's long-term success. It's a winning combination.

Room for expansion, with additional drilling commencing soon

Extend existing deposits

Key to U.S. GoldMining's mission is to delineate the true size of Whistler's porphyry centers—including that aforementioned high-grade core. The Company is already drilling gaps in Whistler's mineral resource model, with the aim of expanding the existing resource. There are several places where this may be possible. It's easy to see how extending existing deposits could move the stock if the Company is able to do so.

Upgrade inferred resources to indicated

With ongoing infill drilling and updated geological modeling, the Company aims to convert as many of those 6.4 million inferred ounces to the higher-confidence indicated category. If it is able to accomplish this, it will make the project more attractive and valuable.

Test 'satellite' targets

In the Whistler ‘Orbit’ area, surrounding the existing Whistler and Raintree Deposits, the Company has identified numerous additional, potential porphyry targets and is undertaking geological investigations to determine whether they warrant further attention.

Look for new discoveries on the property

Within the geology of the larger Whistler property, there could be brand-new mineral discoveries just waiting to be uncovered.

Success in executing on any of these four plans may have material consequences for the value of Whistler, and in turn, the value of U.S. GoldMining.

Investors can expect updates in the coming months, particularly as summer begins and the Company's 2024 drill program recommences. Any of these news releases could contain an item that changes the outlook of the Company.

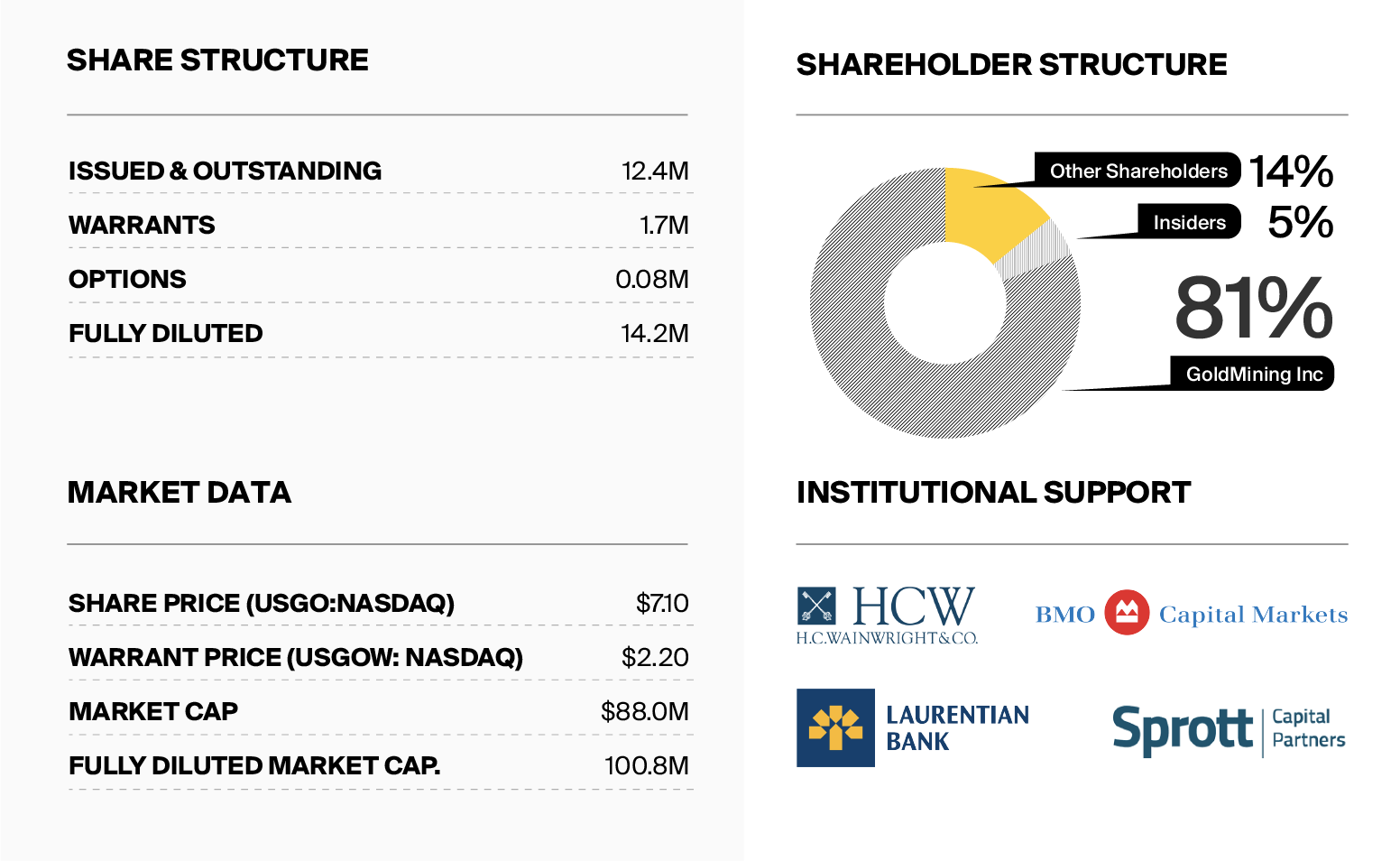

A tight share structure, skin in the game, and cash on hand

In addition to a stellar project and team, U.S. GoldMining's capital structure is encouraging.

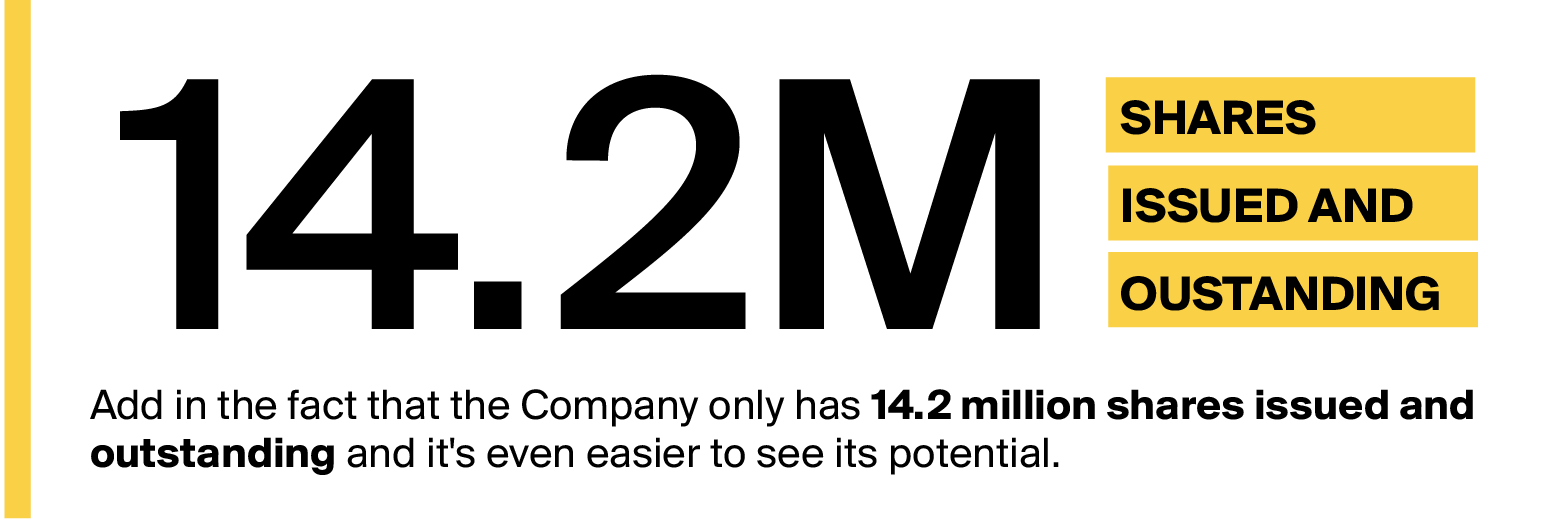

The Company has only 14.2 million shares outstanding fully diluted, with approximately 80% owned by its parent company, GoldMining Inc.—much of whose team overlaps with U.S. GoldMining's—and an additional 5% owned by insiders.

This skin in the game shows huge faith in U.S. GoldMining's ability to accomplish its mission, and is a key factor in any precious metals investment.

And the Company has approximately US$11.4 million in cash on hand, meaning that USGO is well-financed for its future plans. It has no plan for a private placement in the near-term, meaning there's little risk of dilution.

Ounces in the ground, catalysts on the horizon, and an A+ team—what more could you ask for?

Between the Whistler project, the Company's management, and its plans for the immediate future, we believe that U.S. GoldMining is well worth your attention today.

There's no telling what could happen with the Company in the coming months and years, but it already has a district-scale deposit in a mining-friendly jurisdiction. It already has promising drill results and a resource estimate. It already is backed by a team that knows how to make things happen.

And, it's already drilling the property, with more assays expected as drilling progresses during the summer.

Furthermore, USGO trades at a discount when compared to its peers, and though nobody can predict the future, it may not stay that way for long.

And with only 14.2 million shares issued and outstanding, any movement is likely to be dramatic. Now is the ideal window for investment.

We are looking at a huge potential investment opportunity, an under-the-radar stock pick that comes around once a decade, and certainly not the type that waits around while investors make up their mind.

Consider adding U.S. GoldMining to your watchlist, do your due diligence, and determine whether it's right for your portfolio sooner rather than later. You may be glad you did.

To learn more about U.S. GoldMining Inc. (NASDAQ: USGO)

Full Disclosure: U.S. Gold Mining Inc. is a paid sponsor of PrivatePlacements.com.

Disclaimer: The service and the contents are provided by the sender and other information providers on an "as is" basis. The sender and any and all other information providers expressly disclaim any and all warranties, express or implied any information herein or on PrivatePlacements.com.

PrivatePlacements.com and its and its owner and its owner's directors, employees, consultants, contractors, agents, and the like ("Representatives"), do not give any tax or investment advice; and do not advocate the purchase or sale of any security or investment. Contents are intended as general information. None of the contents constitutes an: (1) offer to sell or the solicitation of an offer to buy by Blender Media and/or its representatives any security or other investment; (2) offer by PrivatePlacements.com or its owner and/or their representatives to provide investment services of any kind; and/or (3) invitation, inducement, or encouragement by Blender Media and/or its representatives to any person to make any kind of investment decision. You should not rely on the content for investment or trading purposes. Securities or other investments referred to in any of the contents may not be suitable for you, and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a person authorised to give it. All communications by PrivatePlacements.com are subject to its terms of use and disclaimer, which can be viewed here and here.

The Company has prepared disclosure in accordance with Canadian reporting standards, which differ from the requirements of the U.S. Securities and Exchange Commission (the “SEC”). The terms “mineral resources”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” used in this presentation are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the “CIM Standards”), which definitions have been adopted by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Accordingly, information contained in this document providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder. Investors are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Standards, “Inferred mineral resources” are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Canadian standards, including the CIM Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the “SEC Modernization Rules”), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be substantially similar to corresponding definitions under the CIM Standards. During the period leading up to the compliance date of the SEC Modernization Rules, information regarding mineral resources or reserves contained or referenced in this presentation may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be “substantially similar” to the CIM Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

Tim Smith, the Company’s Chief Executive Officer and a qualified person as such term is defined under Item 1300 of Regulation S-K in the United States and Canadian NI 43-101 is a professional geoscientist and member of the Professional Geoscientists Ontario, Engineers and Geoscientists British Columbia and Northwest Territories Association of Professional Engineers and Geoscientists . He has reviewed and approved the scientific and technical information contained herein regarding the Company’s Whistler Project.

1 See Technical Reports titled “S-K 1300 Technical Report Summary Initial Assessment for the Whistler Project, South Central Alaska” with an effective date of Sep 22, 2022, available under USGO’s profile at www.sec.gov; and the “NI 43-101 Mineral Resource Estimate for the Whistler Project” with an effective date of Sep 22, 2022, available under USGO’s profile at www.sedarplus.ca.

The Au Equivalent equations are: below 10g/t Ag: AuEq=Au + Cu*1.5733 +0.0108Ag, and above 10g/t Ag: AuEq=Au + Cu*1.5733

2 McKinsey & Company, "Can the gold industry return to the golden age?" 2019, Link.

3 Mining Technology, "How did M&A perform in mining in Q4 2023?" Feb. 2024, Link.

4 See results from news release titled "U.S. GoldMining Intersects 547 meters at 1.06 g/t Gold Equivalent Including 176 meters at 1.55 g/t Gold Equivalent at the Whistler Gold-Copper Project, Alaska," Link.

5 "Goldcorp to buy Yukon-focused Kaminak Gold in $520 million deal," The Star May 12, 2016. Link.