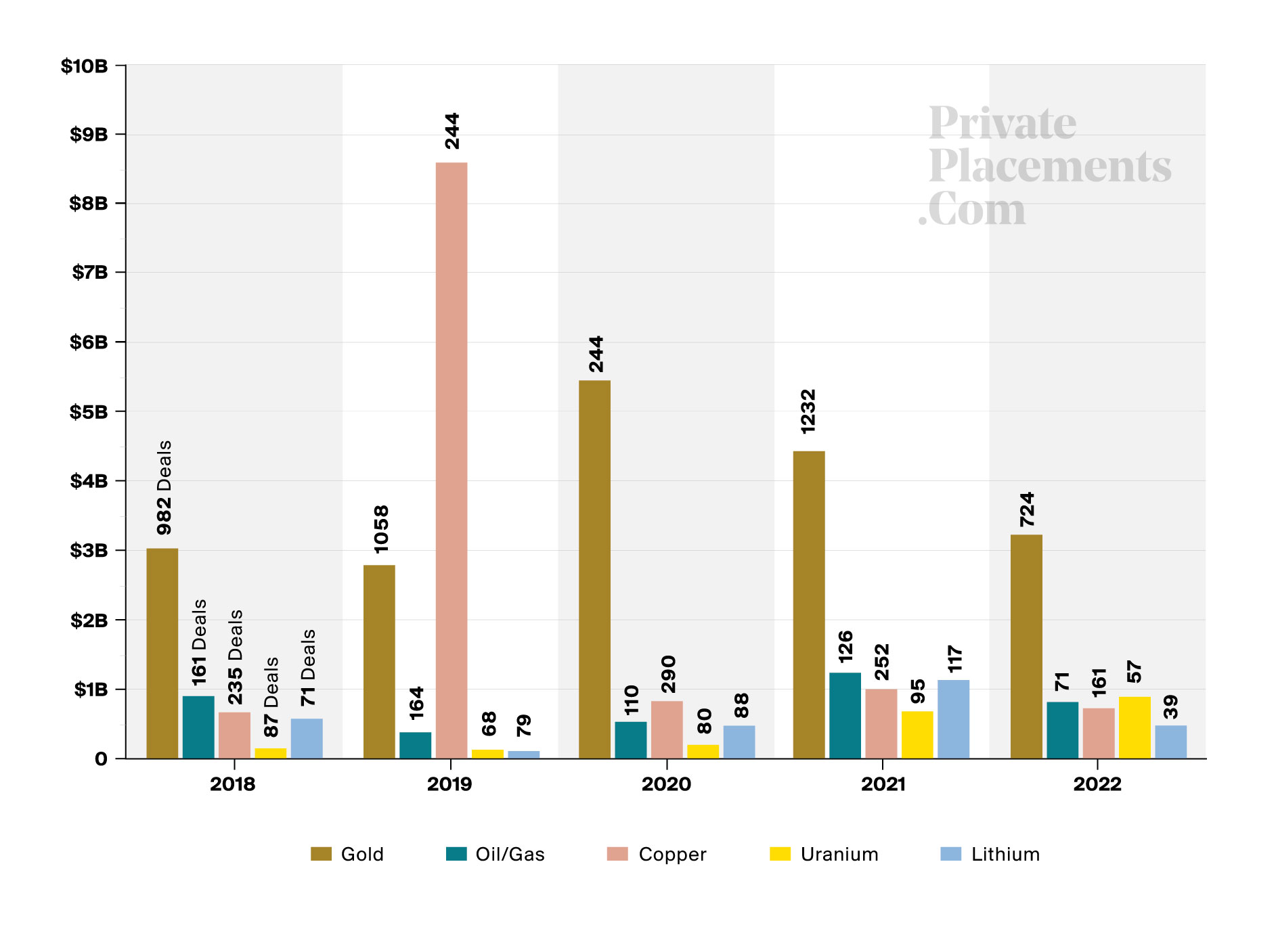

To give our readers deeper insights into investments by way of equity financings, and flow of capital in natural resources over the past half-decade, we created a chart that shows total equity capital dollars raised (plus number of deals) for gold, copper, uranium, lithium, and oil & gas.

But first a word from our sponsor: Sprott’s new Resource Exploration Development Private Placement Limited Partnership (RED LP).

The RED LP is a private placement-focused fund that distills Sprott's experience, access, and private placement origination capabilities into a single investment vehicle.

The primary focus of the fund is to secure private placements in publicly-traded natural resource companies. For those of you interested in investing in private placements, we invite you to visit the RED LP micro-site to learn more about the fund, as well as private placement investing in natural resources.

Now, onto the data.

As you can see, in the past five years, gold has far outpaced the other listed industries, while uranium has steadily increased as the metal has gained attention.

It's important to note that past performance does not indicate future returns. It will be interesting to see how these trends shift in the coming years.

Full Disclosure:

Past performance is no guarantee of future returns.

An investment in a private placement involves a high degree of risk and is not suitable for all investors. Private placements are highly speculative including the complete loss of principal and lack of liquidity.

The intended use of this material is for information purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The investments discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a possible loss of the principal amount invested. Past performance is no guarantee of future returns. Sprott Asset Management USA Inc., affiliates, family, friends, employees, associates, and others may hold positions in the securities it recommends to clients and may sell the same at any time.

Generally, natural resources investments are more volatile on a daily basis and have higher headline risk than other sectors as they tend to be more sensitive to economic data, political and regulatory events as well as underlying commodity prices. Natural resource investments are influenced by the price of underlying commodities like oil, gas, metals, coal, etc.; several of which trade on various exchanges and have price fluctuations based on short-term dynamics partly driven by demand/supply and also by investment flows. Natural resource investments tend to react more sensitively to global events and economic data than other sectors, whether it is a natural disaster like an earthquake, political upheaval in the Middle East, a pandemic or release of employment data in the U.S. Low priced securities can be very risky and may result in the loss of part or all of your investment. Private funds may have limited liquidity and you may not be able to exit a private fund investment when you wish, dependent on the limited partnership agreement. In some cases, the fund may fall quickly in value. Investing in foreign markets may entail greater risks than those normally associated with domestic markets, such as political, currency, economic and market risks. You should carefully consider whether a fund trading in low priced and international securities is suitable for you in light of your circumstances and financial resources. Sprott Global, entities that it controls, family, friends, employees, associates, and others may hold positions in the securities it recommends to clients, and may sell the same at any time.

Full Disclosure: Sprott Inc. is a paid sponsor of PrivatePlacements.com.

Disclaimer: The service and the contents are provided by the sender and other information providers on an "as is" basis. The sender and any and all other information providers expressly disclaim any and all warranties, express or implied any information herein or on PrivatePlacements.com.

PrivatePlacements.com and its and its owner and its owner's directors, employees, consultants, contractors, agents, and the like ("Representatives"), do not give any tax or investment advice; and do not advocate the purchase or sale of any security or investment. Contents are intended as general information. None of the contents constitutes an: (1) offer to sell or the solicitation of an offer to buy by Blender Media and/or its representatives any security or other investment; (2) offer by PrivatePlacements.com or its owner and/or their representatives to provide investment services of any kind; and/or (3) invitation, inducement, or encouragement by Blender Media and/or its representatives to any person to make any kind of investment decision. You should not rely on the content for investment or trading purposes. Securities or other investments referred to in any of the contents may not be suitable for you, and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a person authorised to give it. All communications by PrivatePlacements.com are subject to its terms of use and disclaimer, which can be viewed here and here.