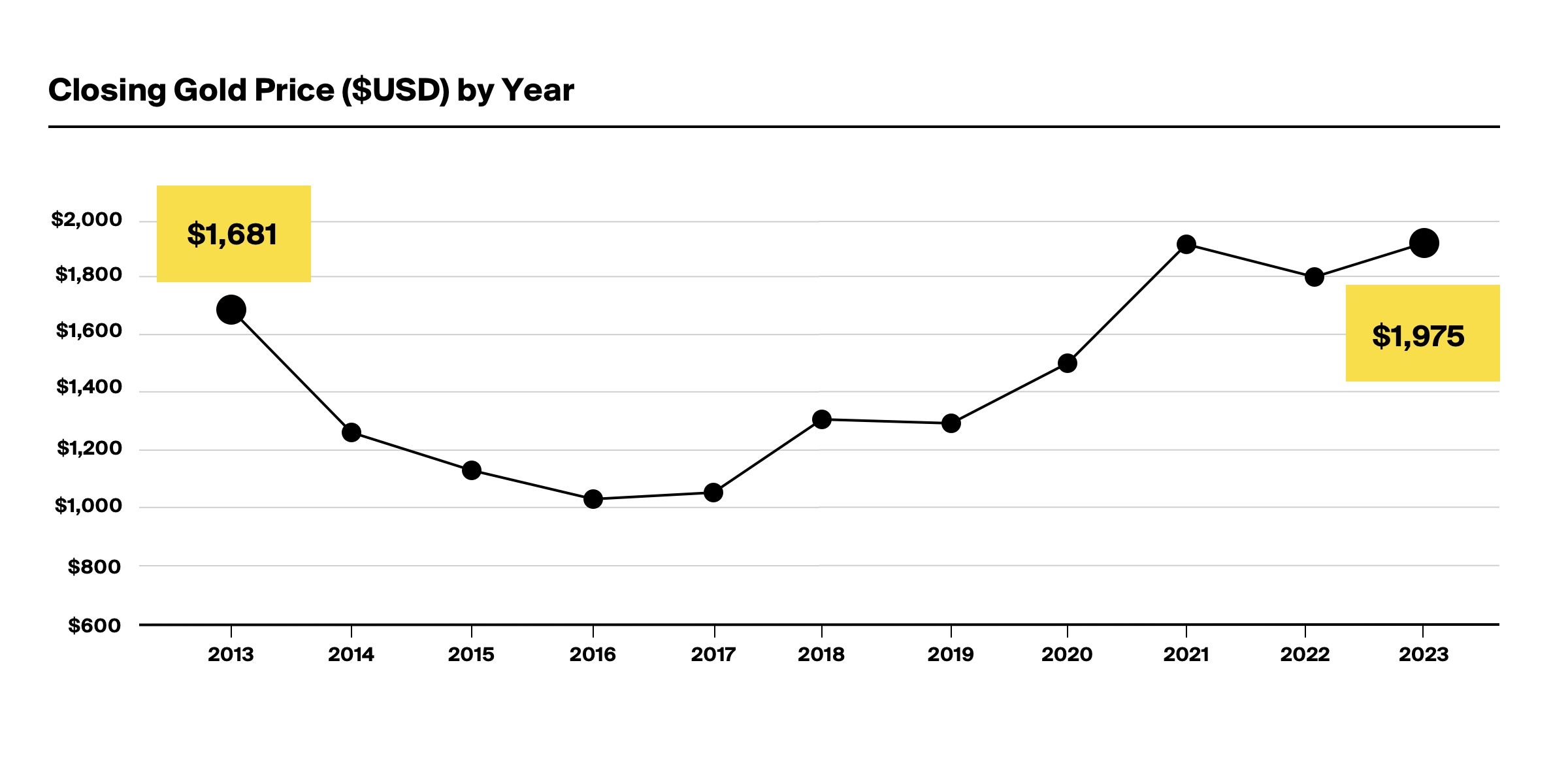

With gold under pressure from a strong U.S. dollar and interest rates expected to stay stable for some time, spot prices for the yellow metal have remained relatively flat for 2023, up just 8.0% despite sticky inflation.

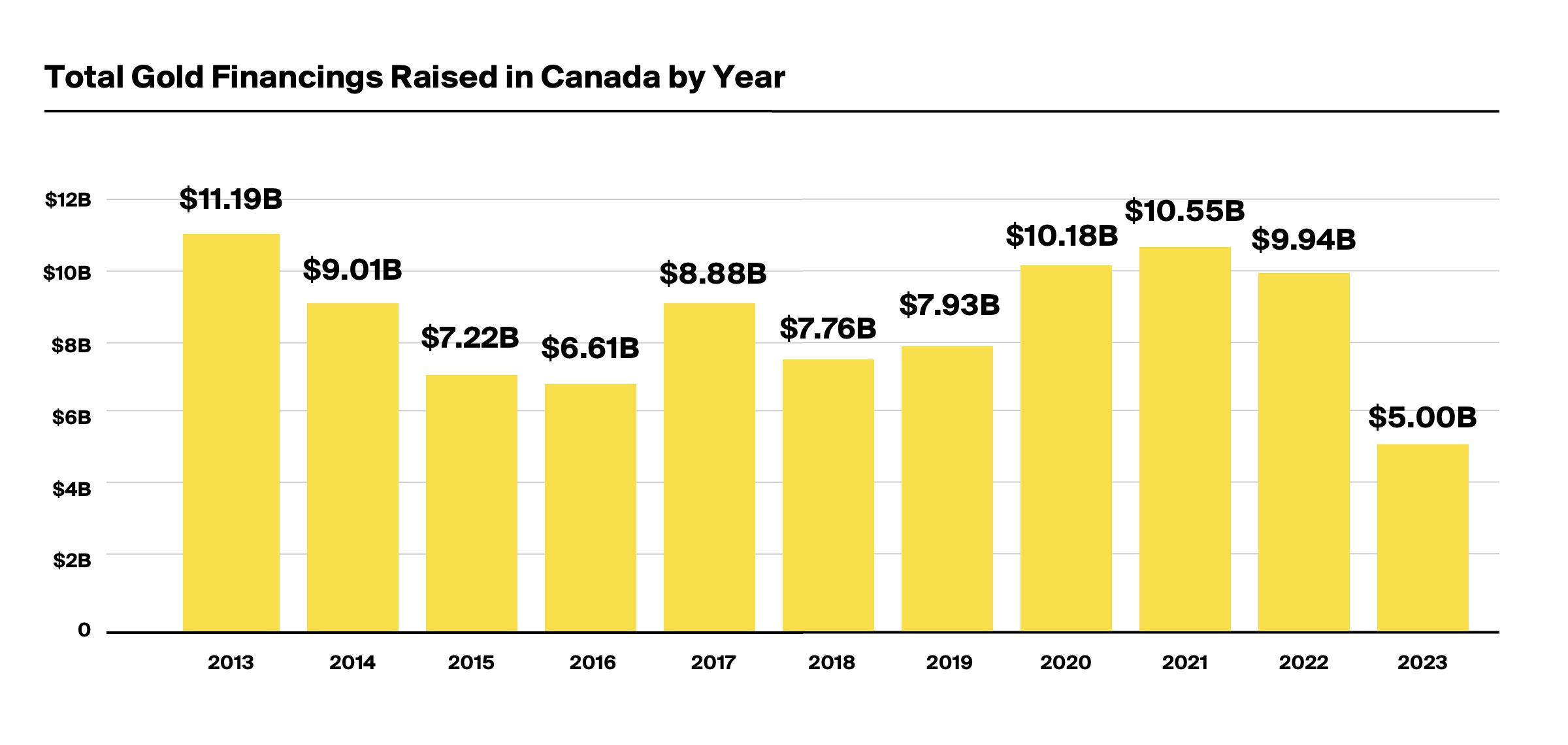

Perhaps as a result, Canadian gold financings year-to-date in 2023 have lagged far behind the last few years, both in number of financings and total dollars raised.

Interestingly, though, this is the most pronounced reversal of a loose link between gold financing dollars vs. the gold price we've seen in the past 10 years. This leads us into a deeper examination of that relationship.

The connection between gold prices vs. financing dollars

Compare these two charts, one showing the total dollars raised via Canadian gold financings over the past 10 years, and the other showing the price of gold over the same period:

As we can see, usually—though not always—when the price of gold goes up, the total financing dollars raised go up. This is true of seven of the nine years surveyed (without considering 2013): a strong correlation, though an imperfect one.

The relationship grows a bit stronger when you examine 2021, one of the years that didn't follow that trend, and see that while financing dollars did increase, it was only by a measly 3.63%. Meanwhile, the price of gold dropped only 3.51%. While that is indeed a discrepancy in the trend, it's not a very strong one. Meaning that really, eight of the nine years surveyed follow the trend.

2013: The biggest financing year of the decade

It's interesting that 2013 is the biggest financing year of the past 10 years by far, outstripping the runner-up—2021—by 6.16%.

We believe that this may be due to the gold bubble that gripped the markets in 2011, in the wake of the global financial crisis and steep quantitative easing in the early parts of the decade. This likely sparked an influx of gold companies both large and small flooding into the financing market to fund their projects. The bubble only began to burst in 2012, and by 2013 it seemed the party wasn't yet thought to be over.

The COVID bump

There's a loose trend for gold financings to increase amidst economic turmoil and geopolitical chaos, much like the price of gold does. The second- and third-most dollars raised in gold financings were in 2020 and 2021, as COVID wreaked absolute havoc on the markets. As the market (slightly) stabilized, those financings have declined, though it's difficult to say that that's exactly why.

Number of closings ≠ dollars raised

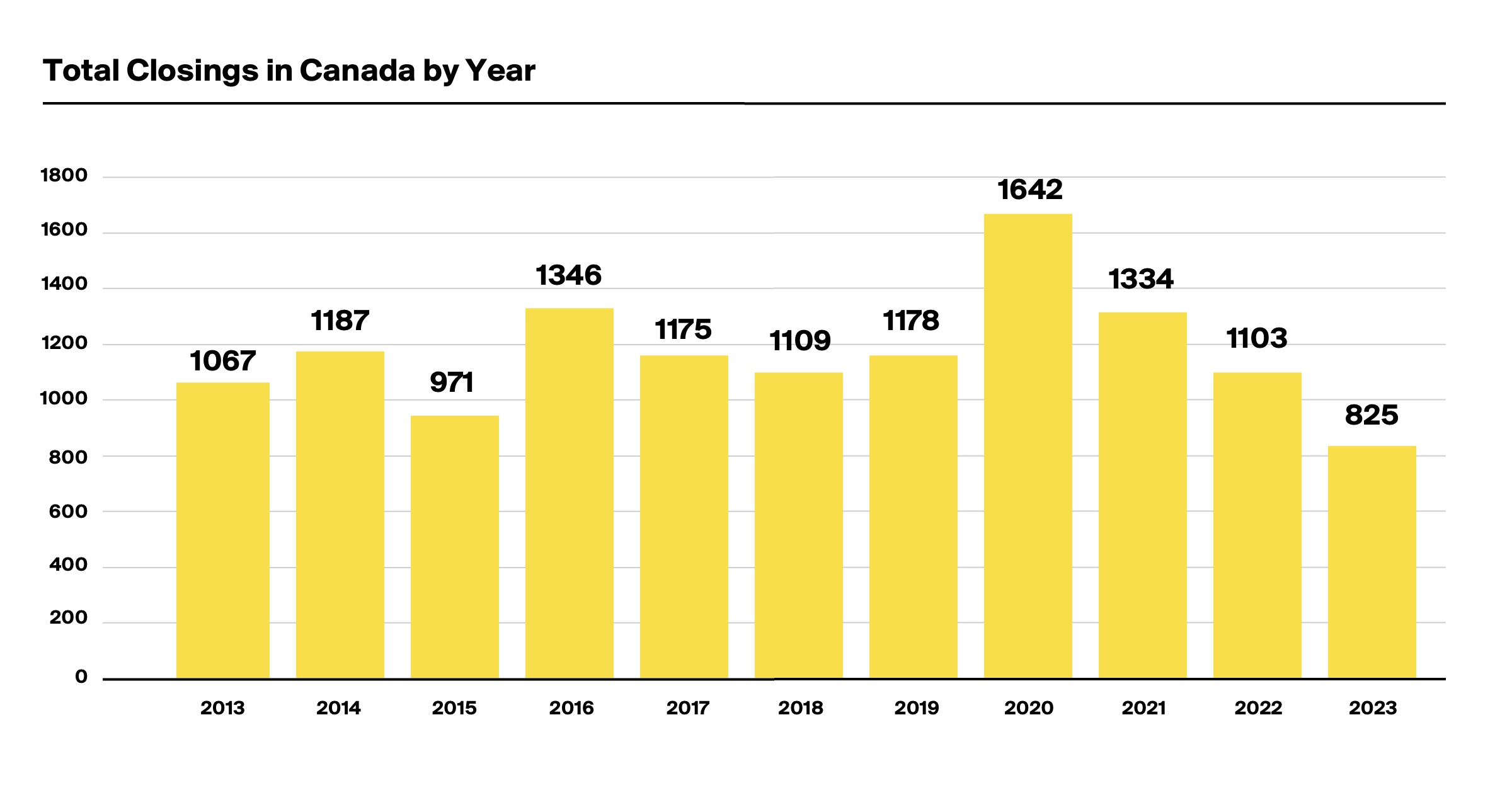

Our final chart covers the total number of gold financings closed by year.

Comparing this chart to the total dollar amounts raised in the chart we shared earlier, we see that there is little correlation between the total dollar amounts and the number of financings. For example, the second-busiest year by number of financings, 2016, was also the year in which the least total amount was raised over the past decade.

2023: The slowest gold financing year of the decade?

That leaves this year, for which the discrepancy is much larger. The price of gold is up 8.00% year-to-date, and yet the total financing dollars raised is steeply down, dropping a whopping 25%.

This is true even when you consider that a little over a quarter of the year remains. At last year's rate, we'd expect the total to be around $8.08 billion this time of year in 2022 — that's still a decline of 38%.

If we extrapolate the current rate of financings for 2023 to the end of the year, we should be at around $6.15 billion on 1,014 financings by the end of the year. That's a big assumption, but if true, this would make it the slowest Canadian gold financing year of the past decade in dollars raised, and close to that in total financings.

This is especially bizarre when you consider that since the beginning of 2013—the biggest gold financing year of the decade—the actual price of gold has increased almost 18%.

So what's going on here? Frankly, we don't know.

One reason may be that we just can't extrapolate the remainder of 2023 just yet, in which case we may see a large influx of new financings in November and December that will bring the year up to even with previous years. Another possibility is that gold companies are just finding funding sources elsewhere more often, amid a strong gold price and market faith in the yellow metal at a decent level.

Whatever the case, it will be interesting to see how 2023 ultimately shakes out in the financing world. We'll be keeping a close eye on the data as it arrives on our financing feed.