Papua New Guinea doesn't get a lot of hype when it comes to the precious metals sector. Though the country has numerous high-profile partnerships with huge mining and energy companies like Barrick Gold Corp. (TSX: ABX) and Exxon-Mobil, you don't see a lot of headlines covering prospective juniors hunting down opportunities in the region.

But in reality, the region is home to some of the most well-endowed deposits in the world. Consider K92 Mining's (TSX-V: KNT) Kainantu mine, which houses a measured and indicated 1.3moz of gold, and output the fourth-highest production grade worldwide in 2020. On top of that mine, there's the Newcrest Mining's Lihir mine and Barrick's Porgera mine, both producing hundreds of thousands of ounces of gold annually.

So when a new junior miner shows up hoping to capitalize on the underexplored Papua New Guinean mineral deposits, we pay attention.

And as the latest new story to enter the Papua New Guinea field, Kainantu Resources Ltd. (TSX-V: KRL), is an interesting company indeed.

READ THE FULL REPORT ON KRL NOW

Kainantu Resources is an early-stage junior gold miner that checks all the boxes:

- Two highly prospective projects located right next to one of the highest-grade mines in the world

- Early-stage potential and a highly experienced management team with deep ties to the PNG community

- $4.1 million cash on hand, a stock that just began trading on the TSX-V, and strong insider ownership

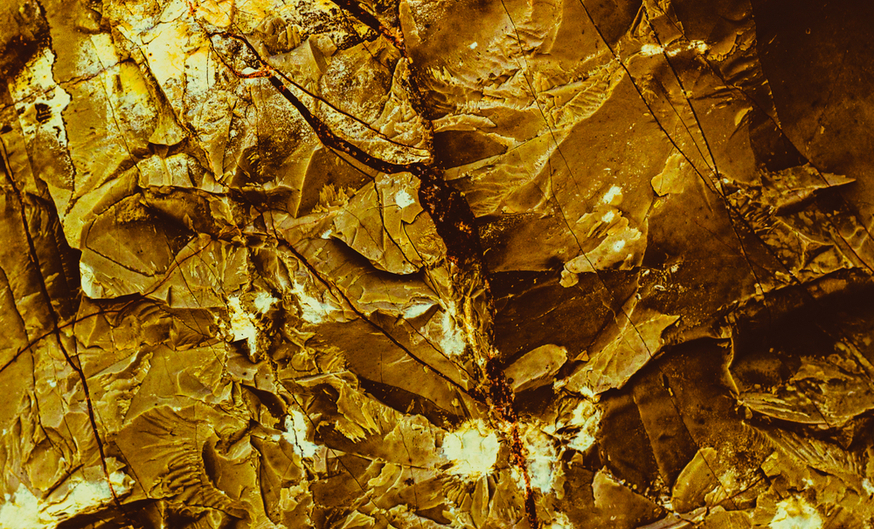

The company is focused on two projects: KRL South and KRL North. KRL South is split by the same faultline that hosts K92's successful Kainantu mine, just 30 kilometres away, and contains remarkably similar mineralization. KRL North is located directly adjacent to K92's mine, on the central Bilimoia mineral field. Both projects are underexplored, with promising findings that previous operators left untapped.

What's more, KRL management hails from a number of regional success stories:

- Archipelago Resources, acquired for US$600 million by Indonesian firm PT Rajawali Corp. in 2013

- Oceanagold Corp. (TSX: OGC), today with a market cap of $1.64 billion

- Asia-Pacific Energy Ventures Inc., which recently opened a 45-megawatt power plant in PNG capital Port Moresby

Kainantu Resources began trading on the TSX-V on Dec. 8, and since then shares have been up and down alongside the price of gold, and early support by the Prime Minister of Papua New Guinea, James Marape. It's early days yet, but we certainly have an eye on the company for further news as it develops.

To learn more about Kainantu Resources, check out our comprehensive report on the company, covering every facet of its investment thesis in detail, including its assets, cap structure, management team, and what to look out for for the stock in the coming months.