Author Paul Harris is a well-known and respected contributor to Kitco and Mining Journal, the founder of the Copper Gold Symposium, CGS Medellin, and CGS Quito, and a mining information analyst with over 24 years of experience in the Americas.

Here, he offers his analysis of our report breaking down the data behind mining equity private placements from 2018-2023. Access the full equity financings report.

Funds raised in private placements for natural resources continued to slide in 2023, totaling C$7.1 billion, 1.78% less than the C$7.2 billion raised in 2022 and 42.4% less than the C$12.3 billion raised in peak year 2019, according to data from PrivatePlacements.com.

The amount raised may be falling, but the number of deals increase 10.7% in 2023 to 1759 compared with 1589 deals in 2022. However, this was 21.6% less than 2020, the peak year for deals.

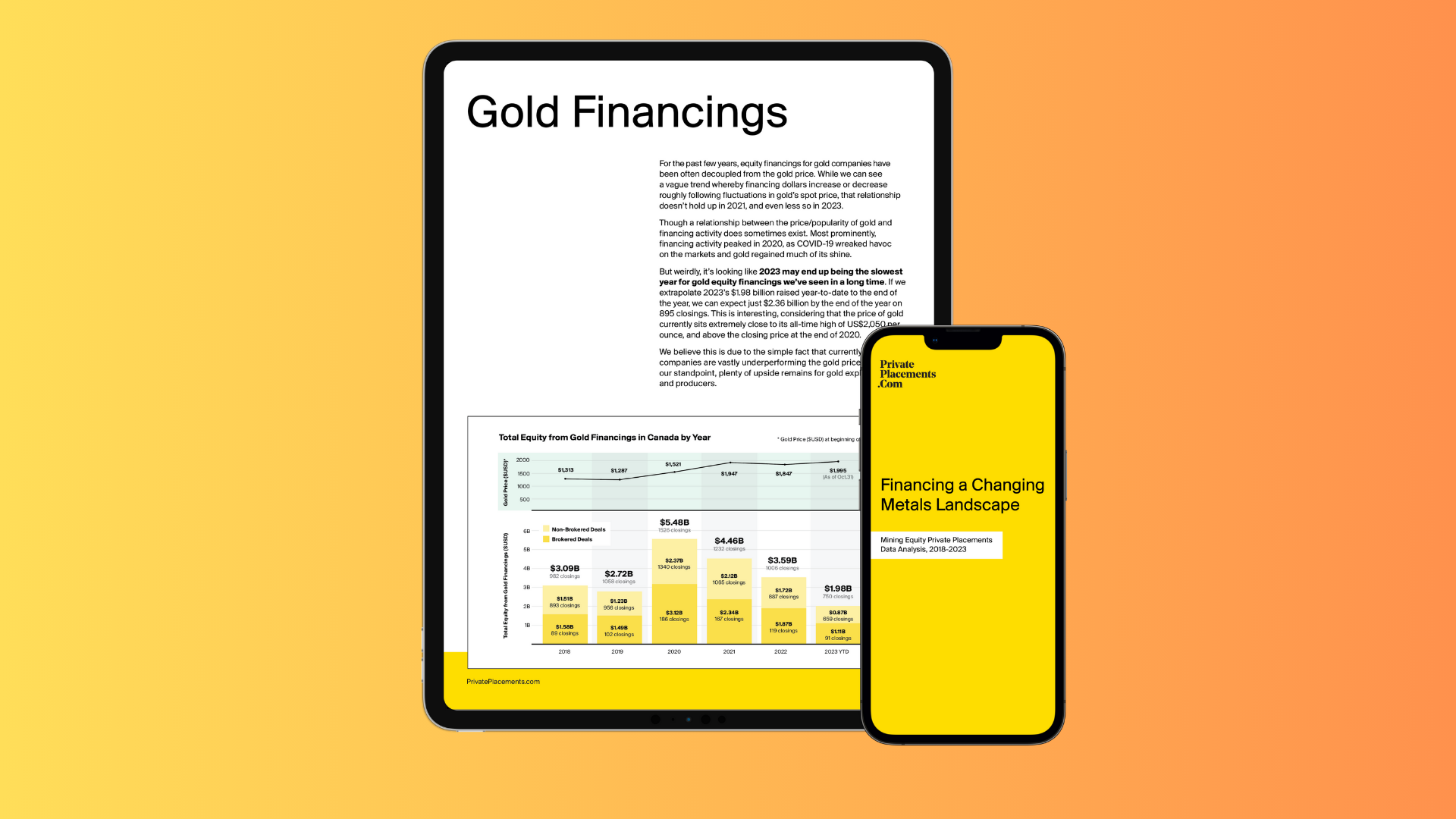

Financings for gold projects continue to dominate the number of deals at roughly 60% of the total. Lithium increased its share to 10.3% in 2023, almost double the 5.5% share in had in 2022. Copper has continuously increased its share of the deal total from 12.9% in 2020 to 15.1% in 2023. Oil & gas has shown a continued decline in the number of deals, from 10% of the total in 2018 to 3.4% in 2023.

However, in value terms, gold has slid from accounting for 63.3% of the dollars raised in 2020 to 36% in 2023, while in the same time frame, the amount raised for copper has increased from 9.3% of the total to 24.6%, while the amount raised for oil & gas has increased to 16.4% of the total from 3.4% in 2019.

The peak year for the amount raised for gold and silver was 2020, with gold raising C$5.5 billion and silver C$1.1 billion. Despite the number of lithium deals increasing in 2023, the peak year in terms of funds raised was 2021 at C$1.2 billion. Copper raised C$1.7 billion in 2023, its best year since 2019, although this amount was 80% less than the C$8.7 billion raised in 2019. Although uranium was one of the hottest commodity markets in 2023, just C$500 million was raised for the commodity, about half the C$1 billion raised in 2022, which was its peak year.

>> ACCESS THE FULL EQUITY FINANCINGS REPORT

As uranium and copper attracted more capital, they also attracted more broker interest with brokered deals increasing for both commodities. Brokered deals accounting for 66.1% of the funds raised for copper in 2023, up from 45.4% in 2020. Brokered deals have raised more than 80% of funds for uranium since 2021, peaking at 89% in 2022 and dropping to 84.2% in 2023. In 2018, they raised 28.8% of funds for uranium.

Lithium saw peak broker interest in 2018 at 87.9% of funds raised, with more interest shown in 2021 with 65.1% of funds raised before tailing off to 35% in 2023.

Brokered vs. non-brokered

As the aggregate amount raised has declined, brokered deals have claimed an increasing portion of the funds raised, accounting for 65.3% of the total in 2023 compared with 47.8% in 2018. Broker interest has remained fairly constant for gold at 51-56% throughout the period. Silver is a different story, growing from 38.5% of funds raised in 2018 to 74% in 2023. Brokered interest in lithium reflects the volatility of that commodity, fluctuating from 17.5% of funds in 2019, the year when just C$881,000 was raised to 65.1% in 2021 when C$10.1 million was raised and 87.9% in 2018 when C$7.6 million was raised.

Copper, uranium and oil & gas tend to see larger broker participation in financings, generating 92.8% of the amount raised for oil & gas in 2023, 97.1% for copper in 2019 and above 80% for uranium over the past three years.

Non-brokered financings have withered to almost nothing in oil & gas, generating just 7.2% of funds in 2023, with a similar story in uranium, where non-brokered participation fell to 15.8% in 2023. Silver has also shown an increasingly weak contribution from non-brokered deals, falling to 26% in 2023. Gold has remained relatively steady at around 45% participation. Lithium, despite its volatility, has managed to see more than 50% participation from non-brokered deals in most years with a high of 82.5% in 2019 and a low of 34.9% in 2021.

The average deal size has remained relatively stable since 2021 at C$4-5million, although the C$4 million average in 2023 was 43.8% less than the C$7.1 million in 2019. A commodity level analysis paints a different picture. The average gold deal size has fluctuated from a high of C$3.6 million in 2021 to a low of C$2.4 million in 2023. Silver has a similar pattern although the average deal size is higher: from a high of C$6.9 million in 2020 to a low of C$3.3 million in 2022, and a rebound to C$5.3 million in 2023. As there are considerably fewer silver companies than gold it appears that they are able to command the markets ear more.

The energy minerals show a growth trend in recent years reflecting changes to energy policy as the world seeks to decarbonise, and the accompanying recognition that renewables alone will not reduce global warming, that nuclear has a vital role to play, and that humanity will need fossil fuels to accompany the growth of alternative fuel sources.

Starting with the latter, funds raised for oil & gas have increased through the period from an average of C$2.6 million in 2019 to C$19.3 million in 2023. Uranium shows a similar pattern, from a low of C$1.3 million in 2018 to a high of C$15.7 million in 2022, and dipping last year to C$5.4 million. The average deal size also shows a similar pattern although with greater volatility, with a low of C$881,000 in 2019 to a high of C$10.1 million two years later in 2021, since when it has fallen in successive years to C$2.9 million in 2023.

>> ACCESS THE FULL EQUITY FINANCINGS REPORT