Here's our latest list of notable financings that went free-trading in the money over the past few days. Read on for all the details.

Note: PrivatePlacements.com has NOT received compensation from any of the companies listed below in connection with this message, nor is the writer an investor in any company listed.

1. NetraMark Holdings Inc. (CSE: AIAI)

- Gross proceeds: $2 million

- Number of units: 10 million

- Unit type: Special units

- Price per unit: $0.20

- Closing date: Sept. 19, 2023

- Today's share price (Jan. 29): $0.35

- Deal appreciation: ~75%

- Warrants: Full

- Strike Price: $0.35

- Expiry date: 09/19/25

Company breakdown

NetraMark is a small-cap company focused on leveraging AI toward the pharmaceutical industry. Its flagship platform, NetraAI, aims to "unlock the potential of [companies'] clinical trials" to draw insights from treatment data.

Interestingly, the above private placement was announced in the middle of a September slump for the company. Even as the financing closed, its share price was in the midst of a recovery, though the stock is roughly flat year-over-year.

Since then, it has announced that it will provide its generative AI tech to an unnamed "large listed biopharmaceutical company," and published new research that indicates that NetraAI may be able to detect potential therapeutic targets that other AIs fail to uncover.

A note about top-performing financings

Lately, we've only been posting one or two companies in our roundup of top-performing financings. This is because not only are there few financings each week (especially lately) that go free-trading in the black, there are even fewer that meet our criteria to write about.

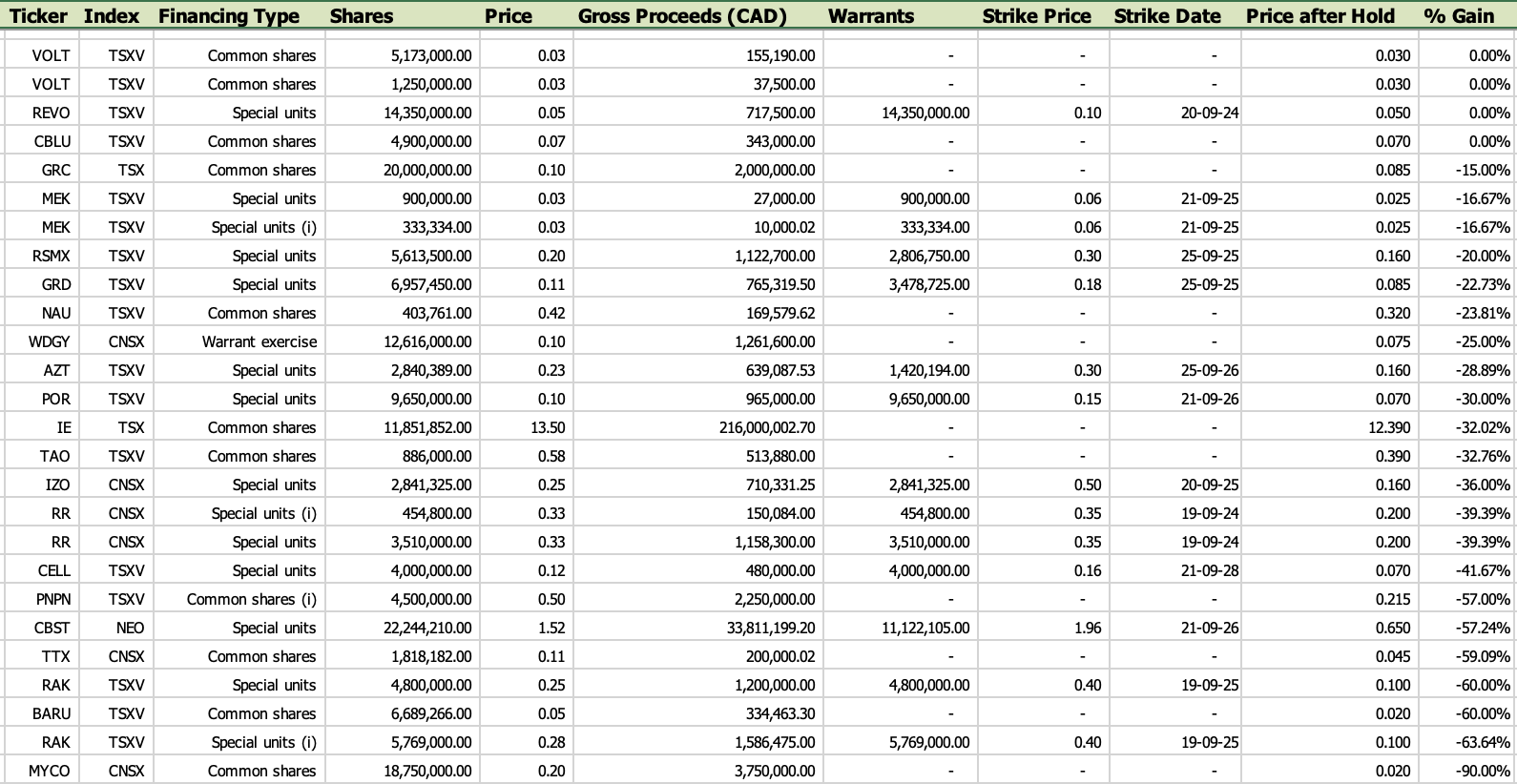

What's more, it's important to note that while many weeks are relatively inactive when it comes to top-performing financings, there are always many financings that go free-trading far below where they started. For example, here is a screenshot of our latest chart, including all the tickers whose financings have gone free-trading over the past week at zero or in the negative:

A poor financing price does not necessarily indicate a bad company; neither does a top-performing financing indicate that a company is a great investment—we merely post this information to help you draw insights in your own investing journey. Keep an eye out for another post next week!