In the first of a new series rounding up the latest news on key commodities, we've got a wealth of perspectives on everyone's favourite trending metals today: uranium and gold.

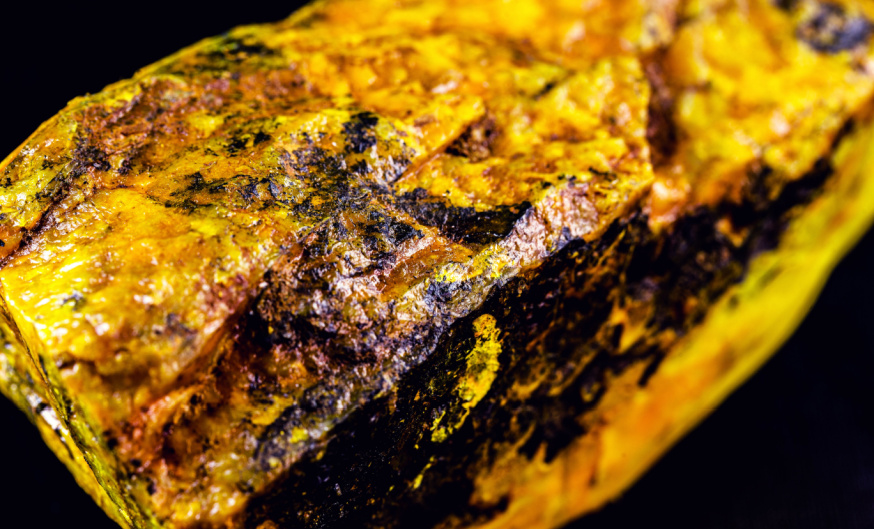

Uranium

The undersupply for uranium looks extreme

It looks like underinvestment in the uranium sector may lead to tremendous undersupply over the coming decade and a half. If projections like this one from Statista are to be trusted, the uranium supply-demand thesis is going to get very spicy indeed.

Cameco cheers "best ever" market conditions, and uranium stocks surge

In today's earnings beat from Cameco CEO Tim Gitzel had an especially cheery take on today's uranium fundamentals:

“We are seeing durable, full-cycle demand growth across the nuclear energy industry. These factors lead us to believe that we are experiencing the industry’s best ever market fundamentals. These dynamics have also led the World Nuclear Association (WNA) to increase its demand forecast in their latest Nuclear Fuel Report to an average annual growth rate of 3.6%, compared to 2.6% in the 2021 report. Furthermore, the WNA has issued a call to action to triple nuclear capacity by 2050 to help the global drive to net-zero greenhouse gas emissions."

Or, to paraphrase:

As a result, uranium stocks took off this morning, most notably Cameco's:

Undersupply may continue long after prices climb

However, as a much-reposted series of tweets from @patrickadownes asserted, there are still a number of investors that are seeing the uranium boom as nothing more than a "pump and dump." To us, the fundamentals are much sounder than that. And as Mr. Downes (and many many others) argue, the current undersupply issues nearly CAN'T be addressed by current uranium players:

As he puts it, long-term underinvestment in uranium has put uranium buyers in a tricky position, and, he argues, would-be uranium producers won't be able to bring mines online quickly even if the spot price continues to climb.

We've always said that uranium is a long-investment game, and today, that story holds more true than ever.

Gold

Gold's story right now may be a little less dramatic than uranium, but sparks are still flying. The spot price for gold almost went $45 short of a new all-time high the morning of Halloween before easing off.

The Israel-Hamas war could be the next big catalyst for gold

We all know that past performance does not indicate future results, but it can still be illustrative to look at historical analogues to our current moment. @TradingForPro argues that if the horrific Israel-Hamas war balloons into a greater conflict—a possibility that seems all-too-real—we could be looking at a swarm of safe-haven investing.

Obviously, this is an absolutely enormous "if," and for humanity's sake we're going to hope his war predictions are incorrect, but the chart is interesting, to say the least.

Gold companies seem decoupled from the price of gold

At the time of writing, gold is trading only about 3% off of its all-time high. But actual mining companies are way, way lower than such a high price wold suggest. As Rashad Hjiyev suggests, the gold companies in GDX would have to collectively rise 50% to climb to a level that links up with the 2020 boom.

Peter Schiff, meanwhile, points out that for gold stocks to reach a 52-week high—which gold is mere points away from—they'd have to climb by almost a third.

So for now, gold is easing off, but it will be interesting to see if it can break through resistance in the coming weeks. There's certainly no shortage of geopolitical catalysts to set it off one way or the other.