The Sprott Red PP

Sprott's new Resource Exploration and Development Private Placement Limited Partnership (RED PP).

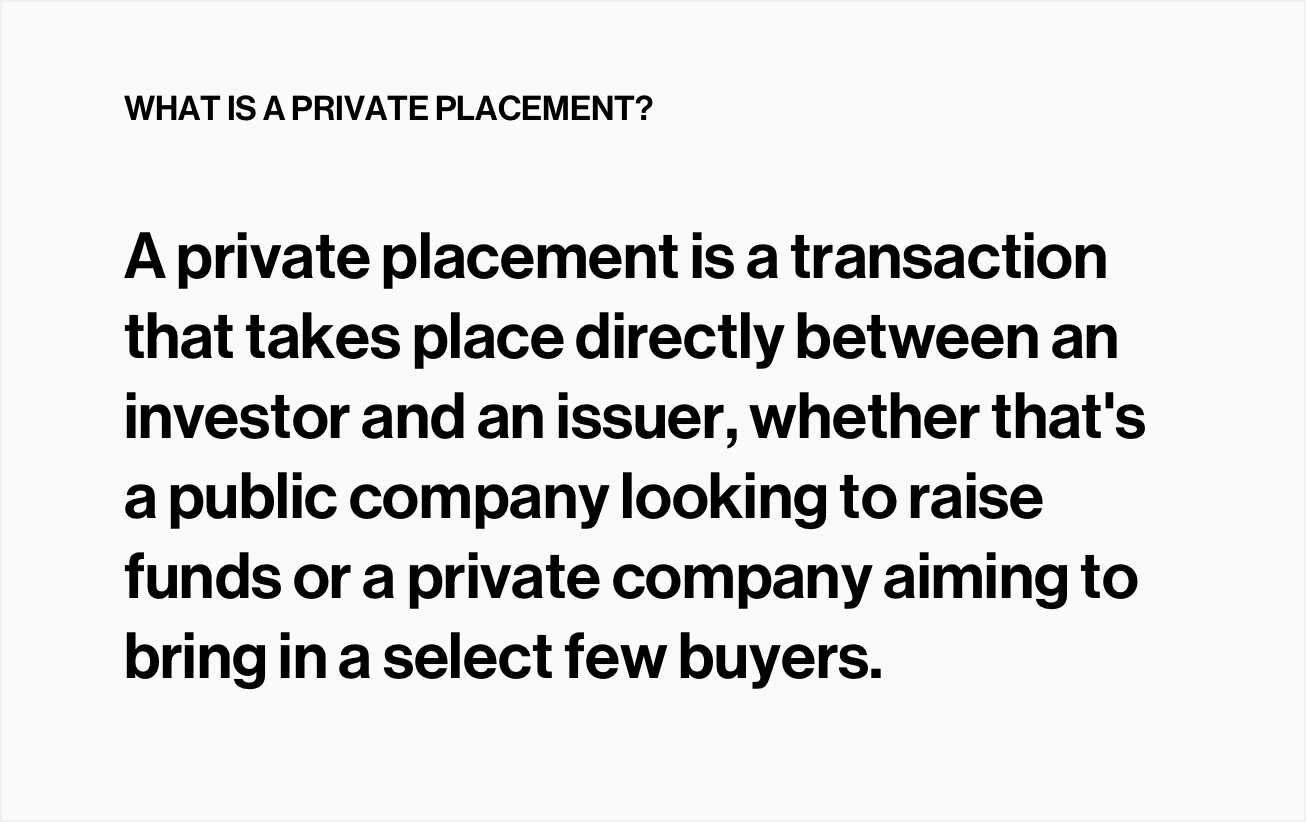

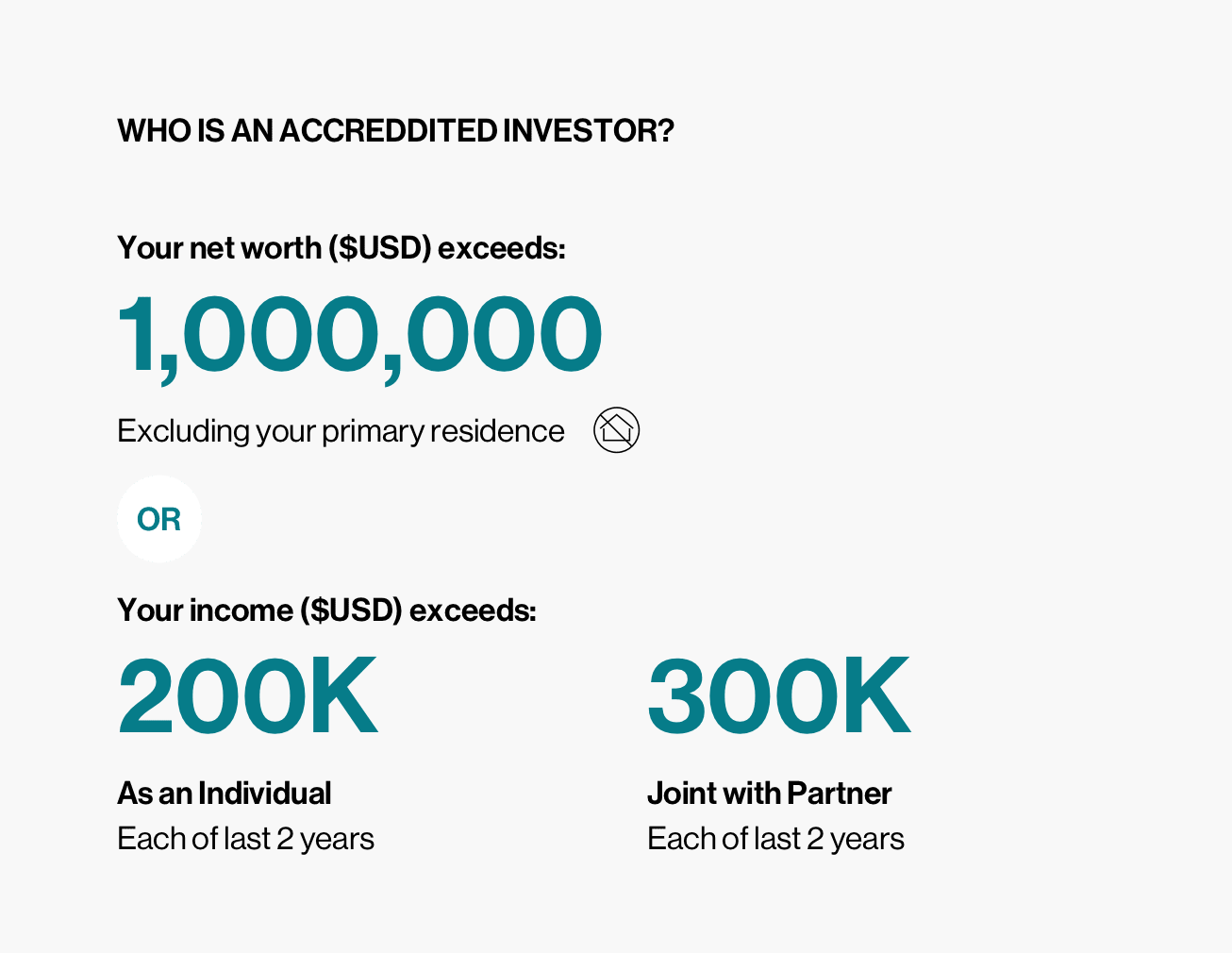

As we previously stated, any individual may have a difficult time making money from private placements. And even if they do, they're likely to be doing so suboptimally, missing out on several deals, selling at the wrong time, or failing to get the best terms possible.

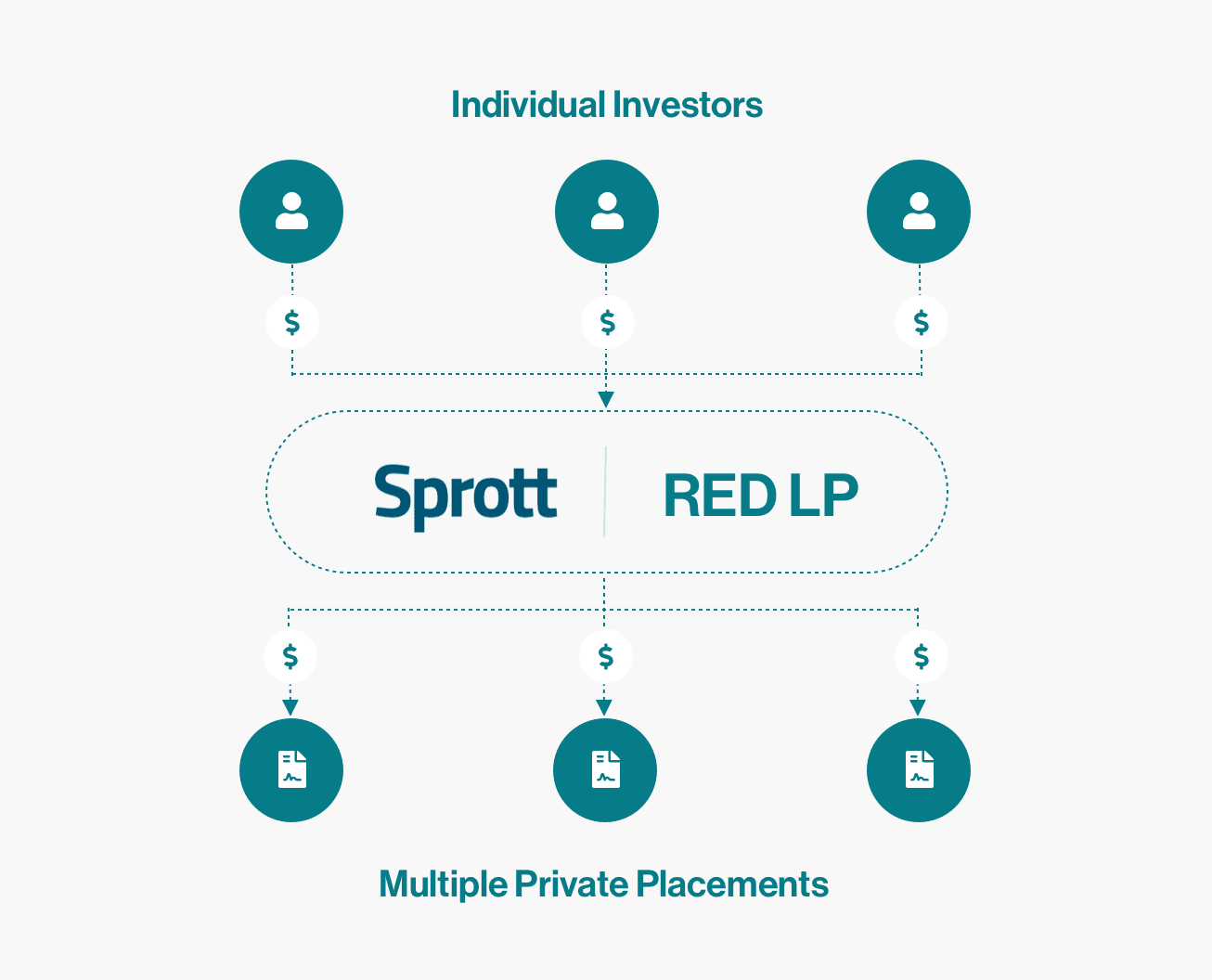

Now, there is a new private fund that addresses most of the above concerns, while providing investors with exposure to resource extraction private placements: Sprott Asset Management, USA, Inc. (Sprott)'s new Resource Exploration and Development Private Placement Limited Partnership (RED PP Fund).

If you haven’t heard of it, that’s not surprising. Sprott isn't big on marketing, and the fund has limited slots available, favoring their existing clients before opening it to the public. We were fortunate enough to have found out about it.

Why the RED PP Fund is one possible way to overcome the challenges of private placements investing

The fund aims to level the playing field and provide a greater number of investors with the opportunity to invest in resource private placements.

The difficulties of individually investing in private placements mean that, for many investors, seeking help from those with experience is an attractive prospect. As an organization with decades investing in resource extraction industries, Sprott is one option.

Investors seeking to invest in private placements while addressing many of the concerns outlined above may consider Sprott's new Resource Exploration and Development Private Placement, LP, or the RED PP Fund. The fund aims to level the playing field and provide a greater number of investors with the opportunity to invest in resource private placements.

The organization has a wide reach within the mining sector. So when the company announces a new, innovative fund to bring more investors into the private placements market, it's news you may want to follow.

What is the Sprott RED PP Fund?

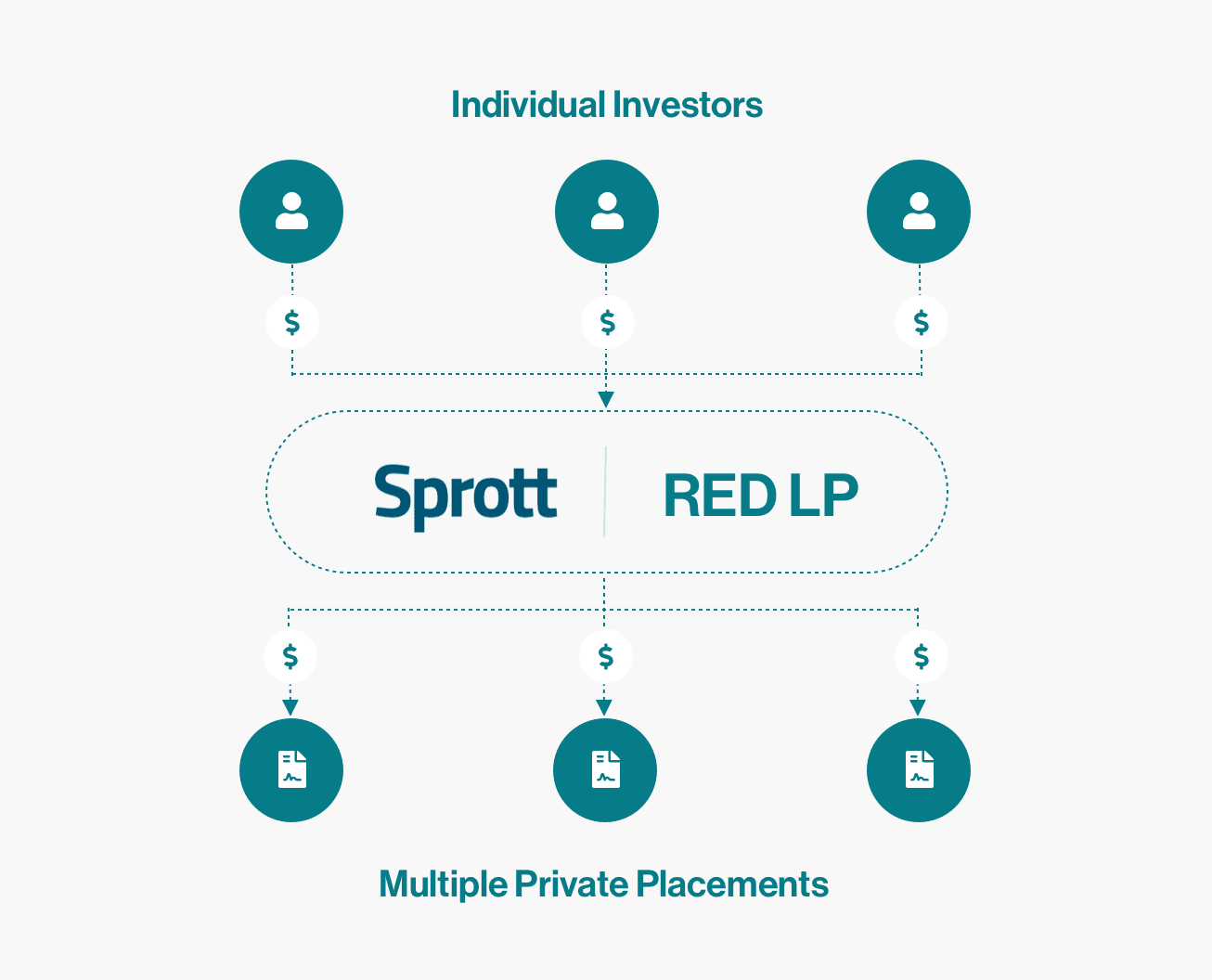

The RED PP Fund is a limited partnership offering that distills Sprott's global research efforts and private placement origination capabilities into a single investment vehicle. The primary focus of the fund is to secure private placements in publicly-traded companies.

The callable nature of the fund means that while limited partners of the fund are required to commit an amount of capital that they are ultimately willingly able to have called upon as deals and transactions are identified. In some past partnerships, all capital had to be provided on day one, meaning that partners had to be patient while the capital was then fully invested, while quality deals may only come across a handful of times in any given year. This means that, with the RED PP Fund, limited partners aren't required to liquidate other investments and then watch as their money sits idle while the fund hunts down good deals in which to invest. The fund will only charge a management fee on capital that is called, not on capital that is merely committed.

Sprott RED PP Management

Justin Tolman

Managing Director, Sprott Inc; Portfolio Manager and Economic Geologist, Sprott Asset Management USA 23 Years of Experience.

The fund is managed by Sprott's investment committee based in Carlsbad, California, each of whom have dedicated their careers to following the mining industry. The investment committee includes four senior brokers and the company's in-house economic geologist, Justin Tolman.

This is an organization with a wealth of experience investing in the mining sector, with networks that stretch into every corner of the field. The group is supported by Sprott's entire research apparatus, and the array of experienced specialists housed within the industry-leading organization. Each member of the team brings something matchless and complementary to the table.

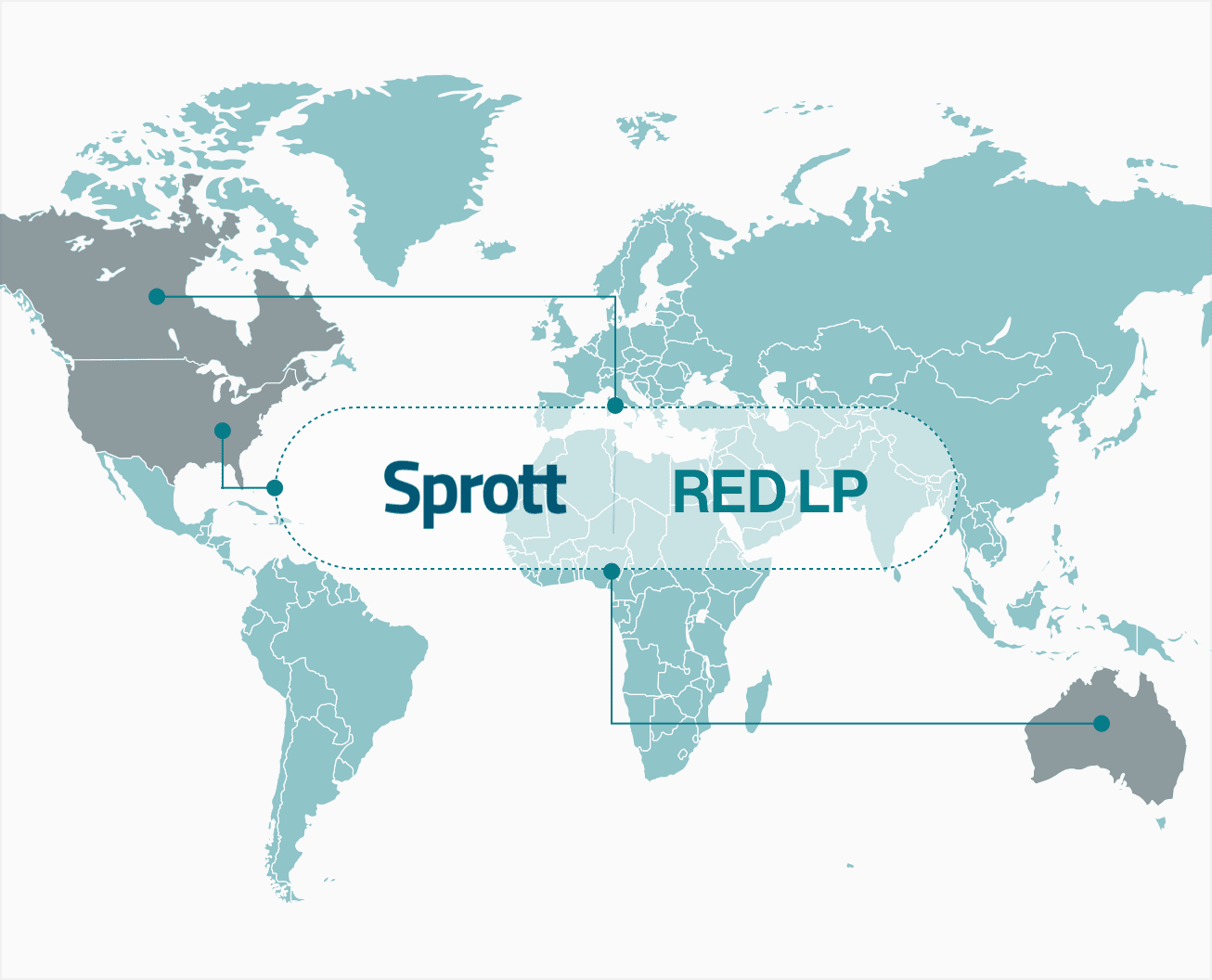

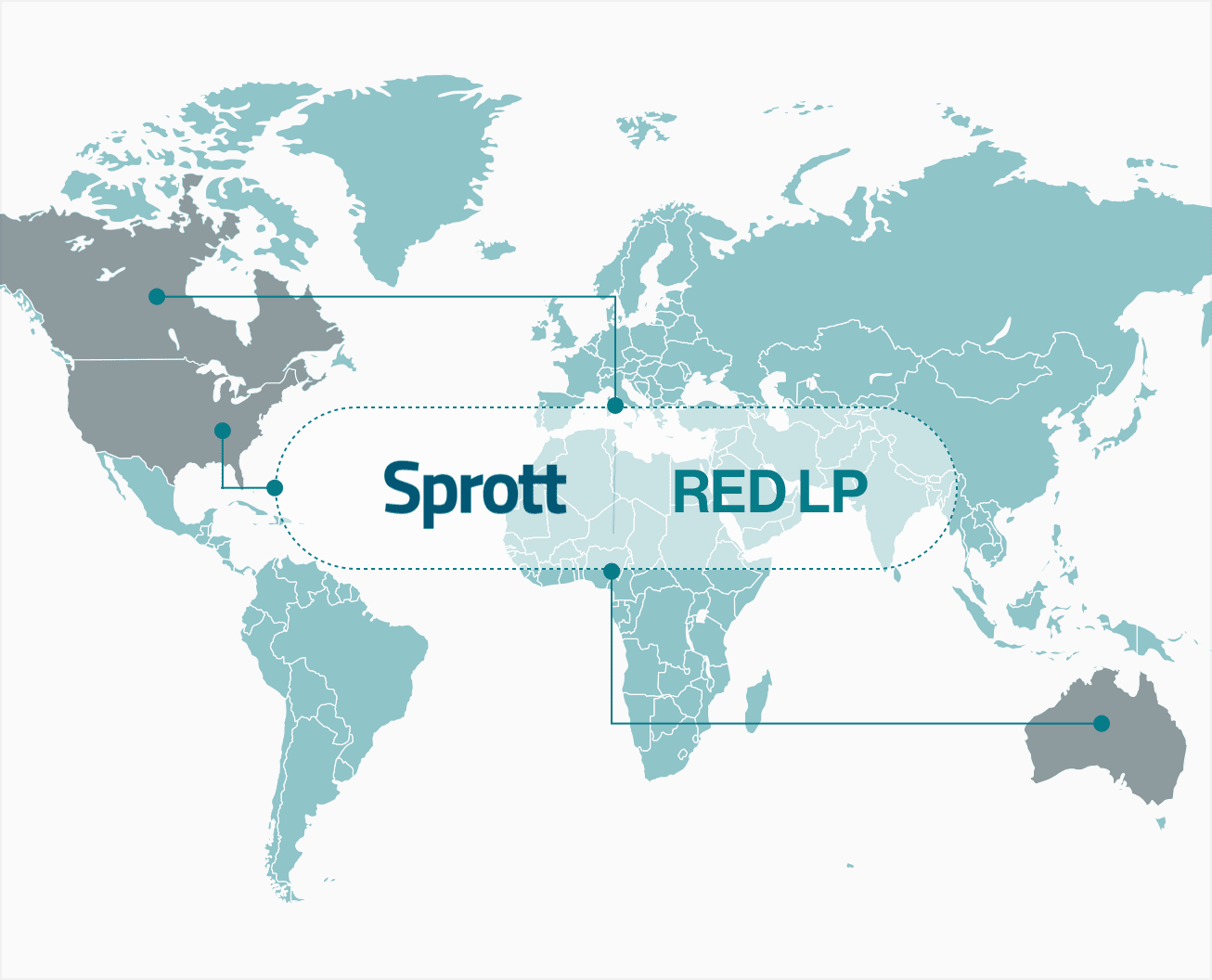

The RED PP won't just grant investors exposure to deals in the U.S. Its reach extends to Canada and Australia, too, eliminating the need for you to track thousands of deals across the globe, while giving you leverage in some of the best resource markets in the world.

What's more, the investment committee has a large stake in the fund, putting significant amounts of their own personal capital into the venture. For the same reason you wouldn't invest in a mining company whose management team lacks skin in the game, the Carlsbad team's participation in the RED PP Fund is deeply encouraging.

The Carlsbad Investment Committee meets regularly to discuss and analyze investment opportunities, voting on those they believe worthy of the funds' capital. The bulk of orders subject to their scrutiny fail to pass the strict standards they require to move forward with the investment, as they're weeded out due to lacking factors like those listed above.

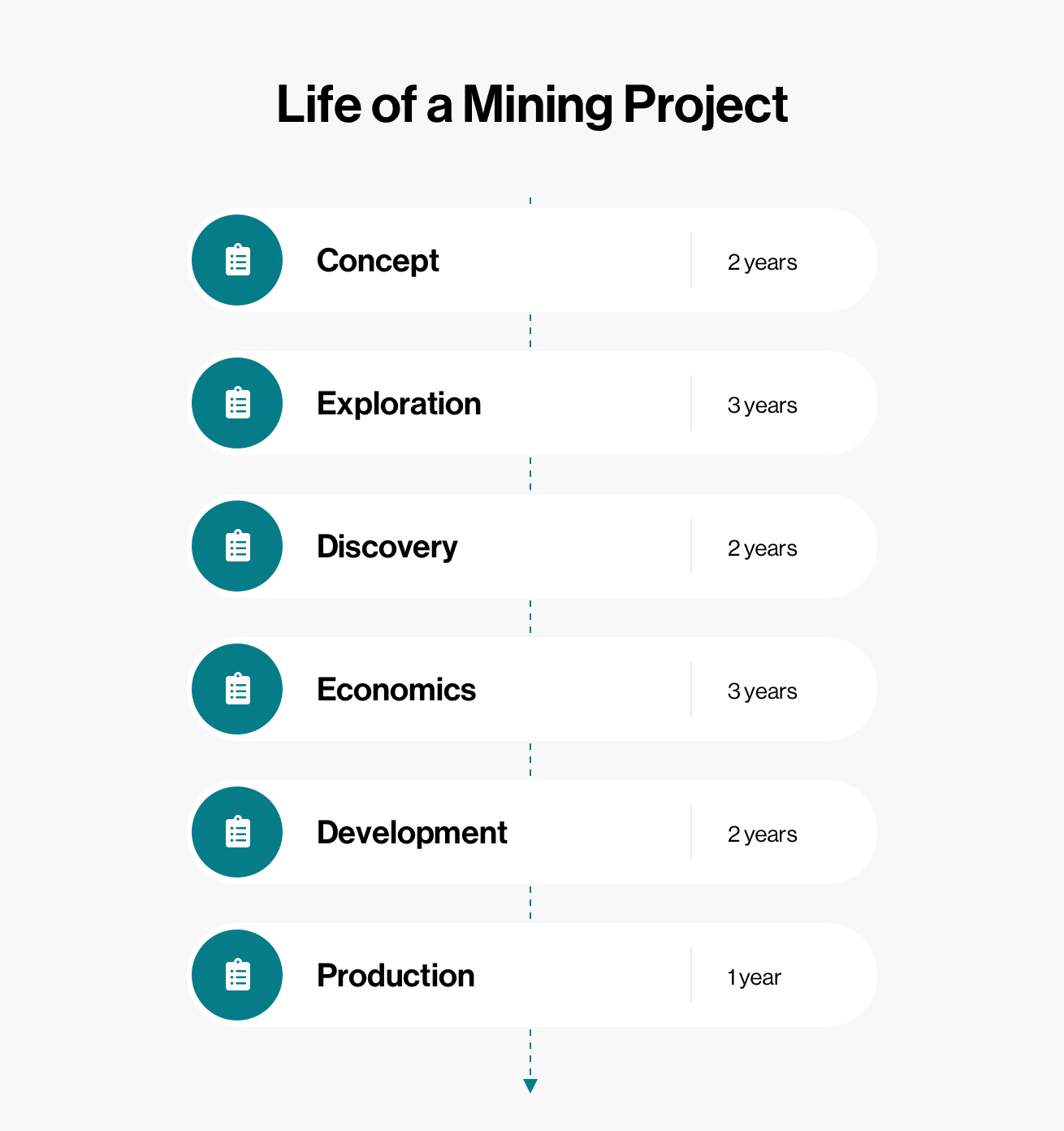

The fund is focused only on long-term investments, and primarily targets public companies, only investing in private companies if there is a reasonable expectation that the company will go public in the near-term. The quality of each company's management team, its resource projects, and a probability-weighted risk/reward analysis drives the fund team's extensive decision-making process.

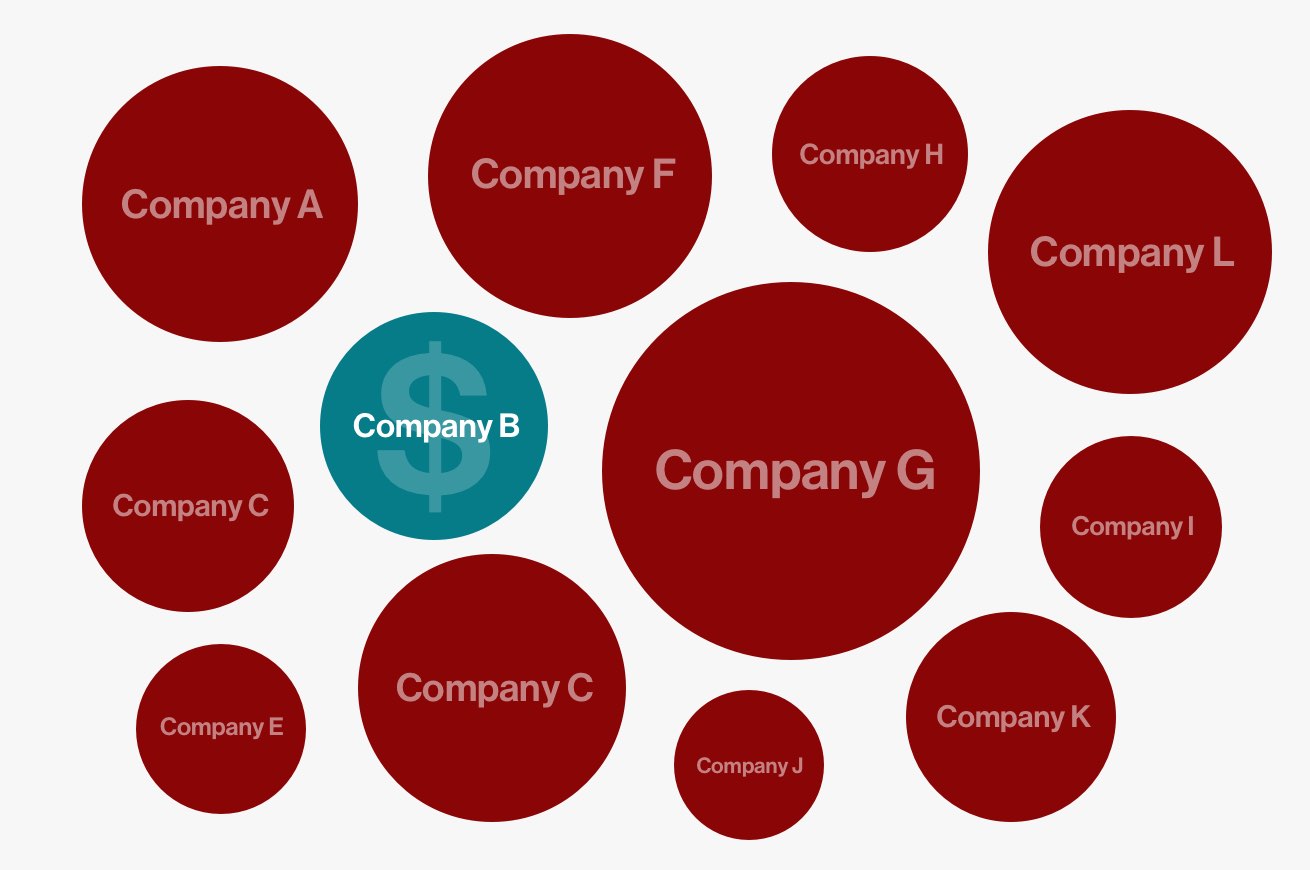

By pooling client capital under a disciplined investment rationale, the fund aims to provide participants with exposure to the resource and development sectors.

This collective approach empowers the fund to dictate better terms on deals, which means there may be better returns for its partners. What's more, the RED PP Fund can act quickly and decisively when potentially lucrative offerings become available, allowing them to capitalize on macro and micro trends. Even if the RED PP Fund isn't the first to approach a particular private placement, it at least stands a much better chance than an individual investor to get access to the deal.

The RED PP Fund won't just grant investors exposure to deals in the U.S. Its reach extends to Canada and Australia, too, eliminating the need for you to track thousands of deals across the globe, while giving you leverage in some of the best resource markets in the world.

Lastly, by participating in the RED PP Fund, you can avoid the piles of paperwork associated with each individual private placement, the headaches that come with hunting the best deals down, and the struggles individuals have in getting access to smaller, less well-known deals.