Alaska: A Trusted Frontier of Gold Exploration

Alaska is one of the most resource-rich mining districts in the world. However, despite being ranked the #2 district on the globe for geological gold potential by the annual Fraser Institute Survey in 2021, the state has gained a bit of a complicated reputation for mining investment in the wake of a few high-profile permitting cases.

But with Alaska Governor Mike Dunleavy and his cabinet at the helm, it's clear to us that the state is more friendly to mining than ever. Meanwhile, of course, the vast untapped resources awaiting beneath its wilderness remains.

Alaska is one district you should definitely be watching. Here, we'll dive into why.

A history of mining

Alaska has a rich history of gold discoveries, dating back to the Klondike Gold Rush of 1896 and the Nome Gold Rush shortly thereafter. The Alaska-Juneau Gold Mine, built from an initial gold strike in 1880, was long one of the most productive gold mines in the world, generating $150 million of gold over six decades. Today, that would amount to over $7 billion.

These historic rushes left a legacy of mining expertise and infrastructure that continues to benefit the industry today. Now, mining companies have access to an extensive network of roads, ports, and airports that provide access to remote sites, which is a huge factor in the success of any project. This infrastructure not only reduces the logistical challenges associated with mining in remote areas but also lowers transportation costs for getting gold to market.

Abundant success stories

More recently, Alaska has seen extensive project and mine development from a wide variety of companies.

Since 1996, Kinross Gold Corp.'s (TSX: K) Fort Knox mine has been a key player in the state's mining industry, having generated well over eight million ounces of gold, with a key expansion—Manh Choh—anticipated to commence production in 2024.

The Pogo mine, owned by Northern Star Resources (ASX: NST), is another, more recent mine. Starting up in 2006, the mine produced 3.6 million ounces of gold by 2017. Since then, production has continued.

Meanwhile, the Donlin gold project, owned by NovaGold Resources Inc. (TSX: NG), is one of the largest undeveloped reserves in the world, containing an estimated 39 million ounces, and with the projected ability to extract 1.1 million ounces per year.

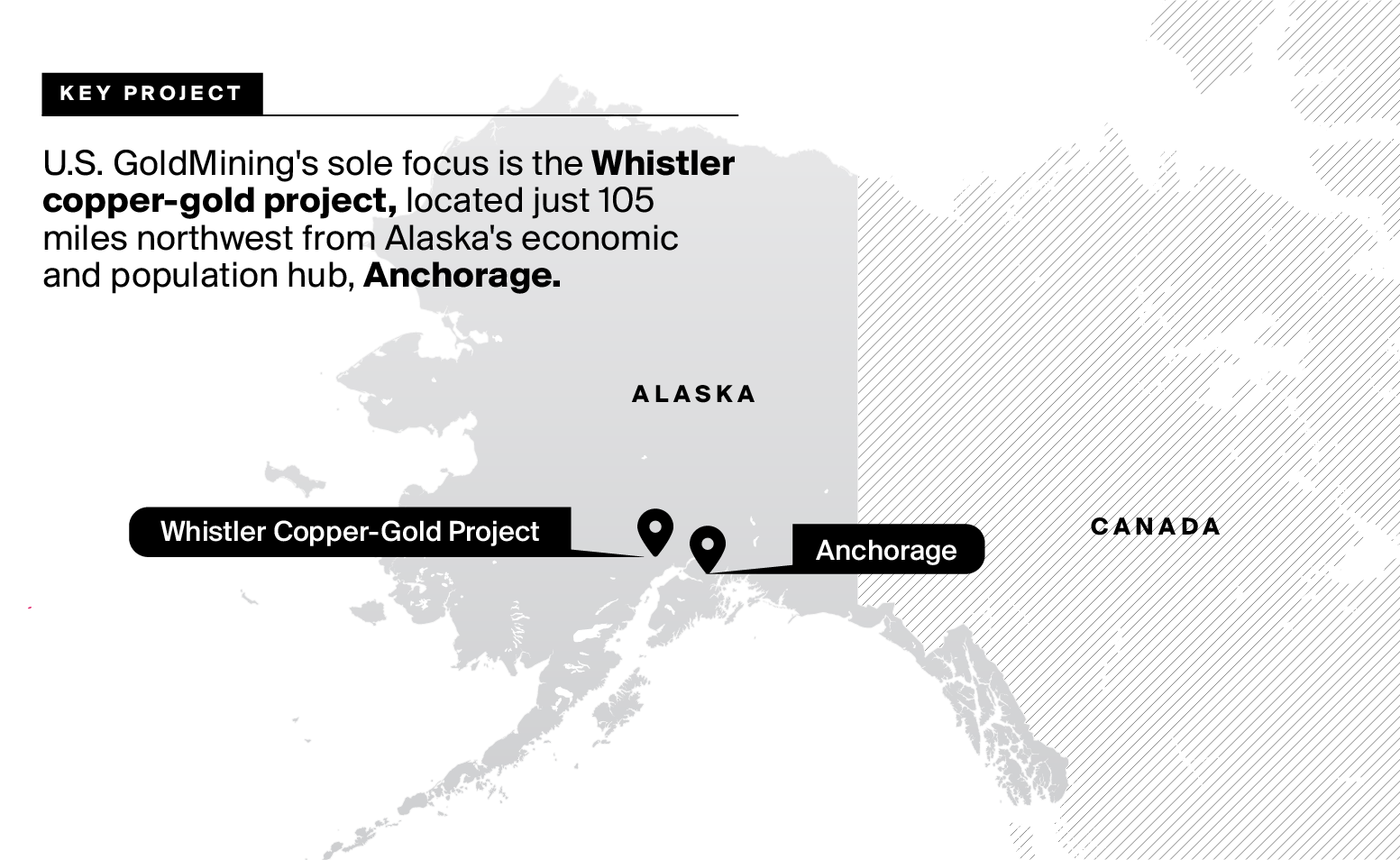

Then there's U.S. GoldMining's (TSX: USGO) Whistler project, only 100 miles from Anchorage with 3.0 million ounces indicated and 6.4 million ounces AuEq inferred. This one is earlier-stage, but with exploration underway and the valuation not yet baked-in to its stock price, it's a promising one to watch.

Pebble setbacks, and today's mining-friendly government

Of course, for all the successes in Alaska, there is one big setback on everyone's mind: the Pebble project. Pebble is a mine proposed originally 20 years ago which has been mired in controversy from local residents, tribal members, commercial fishers, hunters, and environmental groups, since its inception.

The project is the largest known undeveloped copper ore body in the world, worth an estimated $350 billion, but it's also located adjacent to the world's largest salmon fishery—a priceless ecological fixture. Companies involved continually failed to recognize this importance, and also failed to get the essential social license that such a project requires to succeed. The project was officially vetoed by the U.S. Environmental Protection Agency in January 2023.

However, while this has certainly tarnished Alaska's reputation as a mining haven, it's a specific case. Not every project proposed in Alaska will be adjacent to such an ecological keystone, and companies that strive to secure social license from the outset will have far more success. For example, while USGO's Whistler project is located not far from key infrastructure, it is situated far from watersheds or spawning grounds or other foundational ecological bodies. This makes the associated regulatory risk far less than that of mines like Pebble.

And, moreover, the current government is highly supportive of the mining industry. Governor Mike Dunleavy went as far as to pledge to sue the EPA over its Pebble veto, and while we believe nothing is likely to come from that, it shows a fervent support for one of Alaska's key industries.

Future infrastructure development and support

Of course, as we've outlined, governmental support is critical for any gold project to be successful in 2023. Having Mike Dunleavy express his support is a big deal.

The Alaska Department of Transportation and Public Facilities has announced a "Roads to Resources Initiative" to identify resource projects that require additional infrastructure and transportation improvements and provide them.

A potential example of this in action is Mike Dunleavy's recent visit to U.S. GoldMining's Whistler project, accompanied by the company's CEO, Tim Smith, and the Alaska Department of Transportation and Public Facilities Commissioner, Ryan Anderson.

"We greatly appreciate Governor Dunleavy visiting the Whistler project as we ramp up our exploration and development activities at site," Tim Smith said in the news release. "Alaska’s policy under Governor Dunleavy’s administration of investing in critical infrastructure to stimulate growth in Alaska’s economy, was an important catalyst for U.S. GoldMining to launch its highly successful IPO in April 2023."

The next great success story in Alaska?

As you can probably tell, we believe that one especially attractive undeveloped project in Alaska is U.S. GoldMining's Whistler project.

This is due to a few key factors:

- Ounces: The project has 3.0 million gold-equivalent ounces indicated and 6.4M AuEq oz inferred, and ongoing exploration could uncover more

- Team: The company is led by CEO Tim Smith, who was behind the discovery of the Coffee gold deposit sold to Newmont for $520 million, and Chair Alastair Still, who has steered mine construction for Newmont, Goldcorp, Placer Dome, and Kinross

- Infrastructure: The project is located just 100 miles from Anchorage, with state-led infrastructure plans in place

And on top of all that, there's the aforementioned support from Mike Dunleavy and the Alaskan government.

If you're interested in learning more about a gold company mining Alaska, read our full report on USGO. You'll be glad you did.

To learn more about U.S. GoldMining Inc. (NASDAQ: USGO)

Full Disclosure: U.S. Gold Mining Inc. is a paid sponsor of PrivatePlacements.com.

Disclaimer: The service and the contents are provided by the sender and other information providers on an "as is" basis. The sender and any and all other information providers expressly disclaim any and all warranties, express or implied any information herein or on PrivatePlacements.com.

PrivatePlacements.com and its and its owner and its owner's directors, employees, consultants, contractors, agents, and the like ("Representatives"), do not give any tax or investment advice; and do not advocate the purchase or sale of any security or investment. Contents are intended as general information. None of the contents constitutes an: (1) offer to sell or the solicitation of an offer to buy by Blender Media and/or its representatives any security or other investment; (2) offer by PrivatePlacements.com or its owner and/or their representatives to provide investment services of any kind; and/or (3) invitation, inducement, or encouragement by Blender Media and/or its representatives to any person to make any kind of investment decision. You should not rely on the content for investment or trading purposes. Securities or other investments referred to in any of the contents may not be suitable for you, and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a person authorised to give it. All communications by PrivatePlacements.com are subject to its terms of use and disclaimer, which can be viewed here and here.